Chapter 7 and life insurance proceeds: navigating the complexities of bankruptcy and insurance benefits. This intricate subject examines how life insurance policies interact with Chapter 7 bankruptcy proceedings, from initial considerations to potential disputes and resolutions. Understanding the potential impact on debtors, creditors, and the legal framework is paramount.

The guide covers various aspects, including the different types of life insurance policies and their potential impact on bankruptcy proceedings. It details strategies to protect life insurance benefits, the rights and priorities of creditors, and the resolution of disputes. Furthermore, it explores the influence of life insurance proceeds on bankruptcy plans, practical considerations, and recommendations.

Introduction to Chapter 7 Bankruptcy and Life Insurance

Chapter 7 bankruptcy, a common way to wipe the slate clean, allows individuals to get rid of certain debts. It’s like hitting the reset button on your financial life, but it’s important to understand what assets are protected and what might be affected. Life insurance policies often come into play during these proceedings, so let’s dive into the details.

Understanding Chapter 7 Bankruptcy

Chapter 7 bankruptcy is a legal process that lets debtors discharge certain debts. This means the debts are officially wiped out, freeing the debtor from the responsibility of repaying them. The process involves filing paperwork with the court, outlining your assets and debts. A trustee is appointed to oversee the proceedings and ensure the assets are distributed fairly to creditors.

The key takeaway is that while some assets are protected, others might be available to creditors.

Life Insurance Proceeds and Chapter 7

Life insurance proceeds can be a significant factor in a Chapter 7 bankruptcy case. If a policyholder dies, the death benefit is typically paid to the beneficiaries named in the policy. However, if the bankruptcy case is ongoing or filed within a specific timeframe, the proceeds could be subject to the claims of creditors. Common scenarios include when the policy was acquired shortly before bankruptcy or if there’s a dispute over the ownership or payment of the policy.

For instance, if a debtor took out a policy shortly before filing bankruptcy to potentially shield assets, the court might scrutinize the policy and its implications on the overall debt repayment plan.

Legal Framework for Life Insurance in Bankruptcy

The legal framework governing the treatment of life insurance proceeds in bankruptcy is complex. Federal bankruptcy laws, like the Bankruptcy Code, provide the primary guidance. These laws often Artikel specific rules regarding the timing of the bankruptcy filing and the relationship between the policy and the debtor’s assets. Judges interpret these laws on a case-by-case basis, taking into account the specific circumstances of the bankruptcy.

It’s crucial to consult with a bankruptcy attorney to understand the nuances of the situation.

Types of Life Insurance Policies and Bankruptcy Impact

| Type of Policy | Potential Impact on Bankruptcy |

|---|---|

| Term Life Insurance | Typically less affected as it’s often a temporary policy and doesn’t accumulate significant cash value. If the policy was taken out shortly before bankruptcy, it might be questioned by the court. |

| Whole Life Insurance | More complex. The cash value component might be subject to creditors’ claims, especially if the policyholder has a significant cash value buildup. The court will examine the timing of the policy purchase and its relationship to the bankruptcy. |

| Variable Life Insurance | Similar to whole life, the investment component might attract scrutiny. The court will analyze the policy’s investment performance and its connection to the bankruptcy. |

| Universal Life Insurance | Could be subject to similar scrutiny as whole and variable life insurance policies. The cash value component and the investment choices will be examined. |

This table provides a general overview. The actual impact of each policy type on a bankruptcy case depends heavily on the specific circumstances, such as the policy’s age, the amount of cash value, and the debtor’s financial situation. It’s essential to seek professional legal advice for a personalized assessment.

Protecting Life Insurance Proceeds from Chapter 7

So, you’ve got life insurance, a crucial safety net. But what happens if you’re facing Chapter 7 bankruptcy? Can the court grab those proceeds? Not necessarily. There are strategies to keep those funds safe, and understanding them is key.

Chapter 7 bankruptcy and life insurance proceeds can be complex. Understanding your rights and obligations surrounding these proceeds is crucial. For those needing information on food safety, obtaining a food handler card en español might be necessary. However, the core issue remains: navigating the intricacies of Chapter 7 and life insurance payouts requires professional guidance.

Let’s dive in!

Strategies to Protect Life Insurance Proceeds

Various strategies exist to safeguard life insurance benefits during Chapter 7 bankruptcy. Understanding these methods can help you maintain this vital financial protection. Beneficiary designations, policy exclusions, and court considerations play a critical role.

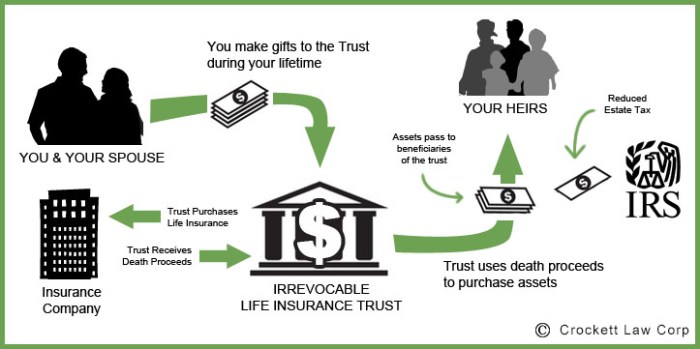

- Beneficiary Designations: Properly naming a beneficiary is paramount. The designated beneficiary typically receives the proceeds outside of the bankruptcy estate. Choosing the right beneficiary is crucial for maintaining the policy’s benefits. For instance, naming a trusted family member or a qualified trust as the beneficiary can significantly help in preserving the funds.

- Exclusions from Bankruptcy Estate: Certain life insurance policies are excluded from the bankruptcy estate. These policies are often considered essential for maintaining a reasonable standard of living and supporting dependents. For example, policies held by a debtor that are specifically exempt under applicable state laws are protected.

- Policy Type Considerations: Different life insurance policy types are treated differently. Term life insurance, often simpler and cheaper, might have different treatment than whole life insurance, which accumulates cash value. The specific rules of the bankruptcy court and the applicable state laws will dictate the policy treatment.

Examples of Excluded Policies

Some life insurance policies are explicitly excluded from the bankruptcy estate. This protection ensures that these policies aren’t used to settle debts. Knowing these examples can help you strategize better.

- Policies held in trust: If the policy is held in a trust, the proceeds are generally not considered part of the bankruptcy estate. This is because the trust’s assets are typically separate from the debtor’s assets.

- Policies with irrevocable beneficiaries: Policies with irrevocable beneficiaries are often shielded from creditors. These beneficiaries have vested rights, making the proceeds unavailable for the debtor’s creditors.

Comparison of Term and Whole Life Policies

Term life insurance typically doesn’t have a cash value component, making it simpler for the bankruptcy court to determine its status. Whole life insurance, on the other hand, often accumulates cash value. This cash value might be considered part of the bankruptcy estate, depending on the specifics of the case. This is a crucial distinction in understanding the possible impact on each policy type.

| Policy Type | Treatment in Bankruptcy |

|---|---|

| Term Life | Generally excluded if the beneficiary is properly named. |

| Whole Life | Cash value component might be considered part of the bankruptcy estate; the specifics depend on the policy’s terms and the court’s interpretation. |

Court Considerations

When a court evaluates a claim to protect life insurance proceeds, several factors come into play. The court’s decision isn’t arbitrary; it’s based on specific criteria.

- Validity of beneficiary designations: The court examines the validity of the beneficiary designations to determine if they are legally sound. Proper documentation is essential.

- Policy terms and conditions: The specific terms and conditions of the life insurance policy are crucial in determining the policy’s treatment during bankruptcy. This includes understanding if the policy has any restrictions or stipulations.

- State laws: Applicable state laws governing life insurance and bankruptcy procedures significantly influence the court’s decision. State-specific rules might provide additional protection or limitations.

Procedures for Filing a Claim

To protect life insurance proceeds during bankruptcy, a proper claim must be filed with the court. This process involves specific steps and documentation to ensure the court recognizes the claim.

- Consult with an attorney: Seeking legal counsel is crucial. An attorney specializing in bankruptcy law can guide you through the complex procedures and ensure your claim is presented correctly.

- Gather necessary documents: Compile all relevant documents, including the life insurance policy, beneficiary designations, and any supporting documentation for the claim. A well-prepared claim is essential.

- File the claim with the court: Submit the claim to the bankruptcy court, following the specific procedures Artikeld by the court. Accurate and timely filing is critical.

Life Insurance Proceeds and Creditor Claims

Yo, peeps! So, we’ve covered Chapter 7 and life insurance, and now let’s dive into how creditors can try to get their hands on those sweet life insurance payouts. It’s a bit of a legal jungle out there, so buckle up!Understanding the rules around life insurance proceeds and creditor claims is crucial, especially if you’re dealing with a Chapter 7 bankruptcy.

Knowing who gets what and how it all works can save you a ton of headaches down the line. It’s not just about the money; it’s about protecting your assets and making sure everyone gets what they’re owed.

Rights and Priorities of Creditors, Chapter 7 and life insurance proceeds

Creditors have varying degrees of access to life insurance proceeds, depending on the type of policy and the circumstances. Sometimes, the policy is considered part of the insured’s estate, and creditors can make a claim. Other times, the policy is specifically designed to keep the proceeds safe from creditors.

Procedures for Creditor Claims

To make a claim against life insurance proceeds, creditors generally need to follow specific procedures Artikeld in the relevant state laws and the insurance policy itself. This usually involves filing paperwork with the insurance company, providing supporting documentation, and potentially going through a court process if the claim is contested.

Examples of Valid Creditor Claims

Here are some examples of situations where creditors might have a legitimate claim against life insurance proceeds:

- A policy taken out as part of a loan, where the loan agreement explicitly designates the insurance as collateral. This is common in mortgages or business loans.

- A debt secured by the insured’s property. If the property is covered by a life insurance policy (e.g., homeowner’s policy), the creditor might be able to claim against the policy proceeds.

- A court judgment against the insured, which may lead to a lien against assets like life insurance.

- A situation where the insured fraudulently obtained the life insurance policy to avoid paying debts, and the court orders the proceeds to be used to satisfy the debt.

Jurisdictional Differences

Different jurisdictions have varying laws regarding creditor claims on life insurance proceeds. Some states have more stringent rules about protecting policy proceeds from creditors than others. It’s crucial to understand the specific laws in your area to know your rights and the creditors’ potential claims.

Comparison of Creditor Types and Potential Claims

| Creditor Type | Potential Claim on Life Insurance Proceeds |

|---|---|

| Secured creditors (e.g., mortgage lenders) | Often have a stronger claim due to the collateral nature of the policy. |

| Unsecured creditors (e.g., credit card companies) | Usually have a weaker claim, depending on state laws and policy specifics. |

| Judgment creditors | May be able to attach life insurance proceeds if a court order is in place. |

| Estate creditors | Claims against the estate, and the policy is considered part of the estate. |

Potential Disputes and Resolution

Life insurance proceeds, while often meant to provide a safety net, can sometimes become tangled in the complexities of Chapter 7 bankruptcy. This section dives into the potential disagreements that can arise and the various methods for settling these disputes, keeping you informed about the process.Disputes concerning life insurance payouts in bankruptcy cases are not uncommon. They often stem from conflicting claims and interpretations of the law, and can involve various parties, including the policyholder’s estate, creditors, and beneficiaries.

Understanding these potential points of contention is crucial for navigating the legal landscape of bankruptcy.

Examples of Disputes

Understanding the types of disputes that can arise is key to navigating the bankruptcy process. Beneficiaries might contest the creditor’s claim on the proceeds, or creditors may dispute the beneficiary’s right to the payout. A common scenario involves beneficiaries claiming the proceeds are exempt from creditor claims. Another example is when the policyholder has multiple policies and creditors dispute the allocation of proceeds across different policies.

Reasons for Disputes

Disputes often stem from unclear policy language, conflicting claims, or disputes about the policyholder’s intent. Unclear designations of beneficiaries, missing or unclear documentation, or the presence of multiple beneficiaries with competing interests can all lead to complex and protracted disputes. For example, a policyholder may have named multiple beneficiaries, and the order of payment or the division of funds may be challenged.

Resolving Disputes

Resolving disputes in bankruptcy requires a systematic approach. The bankruptcy court plays a pivotal role in mediating these disagreements. It is crucial to consult with a qualified bankruptcy attorney to understand the specific steps required to resolve these disputes.

Mediation in Bankruptcy

Mediation offers a less adversarial approach to dispute resolution. It brings parties together to find common ground and reach an agreement outside of court. A neutral third party, the mediator, facilitates discussions and helps the parties reach a mutually acceptable solution. Mediation can be more cost-effective and time-efficient than litigation.

Chapter 7 bankruptcy often impacts life insurance proceeds, potentially complicating matters. While navigating these complexities, consider a delicious treat like this easy dried cranberry muffin recipe to provide a welcome distraction. Ultimately, understanding the specifics of how life insurance proceeds are handled within a Chapter 7 filing is crucial for proper financial planning.

Dispute Resolution Mechanisms

| Dispute Resolution Mechanism | Description | Advantages | Disadvantages |

|---|---|---|---|

| Negotiation | Direct discussion and agreement between parties. | Cost-effective, flexible, and private. | May not always lead to a resolution, and power imbalances can affect outcomes. |

| Mediation | Neutral third party facilitates communication and negotiation. | Less adversarial, potentially cost-effective, preserves relationships. | Not always binding, may not resolve all issues. |

| Arbitration | Neutral third party renders a binding decision. | Faster than litigation, often less expensive. | Decision is binding, may not be suitable for complex issues. |

| Litigation | Formal court proceedings to resolve disputes. | Binding decision from the court, more formal process. | Expensive, time-consuming, and adversarial. |

Impact of Life Insurance on Bankruptcy Plan

Life insurance proceeds can significantly impact a bankruptcy plan, especially when determining how to fairly distribute assets to creditors. Understanding how these funds are handled is crucial for both debtors and creditors. This section dives into how life insurance affects the bankruptcy process, from repayment strategies to maximizing the use of the proceeds.

Influence on Bankruptcy Plan Development

Life insurance proceeds, often a significant sum, can dramatically alter a bankruptcy plan. If the proceeds are substantial, they can significantly increase the debtor’s ability to repay debts and potentially lessen the burden on creditors. Conversely, if the proceeds are modest, their impact on the plan will be proportionally smaller. The plan must meticulously detail how these funds will be used, taking into account the specific debts and the creditor’s claims.

Effect on Debtor’s Repayment Capacity

Life insurance proceeds directly impact the debtor’s ability to repay creditors. These funds can be used to satisfy existing debts, potentially reducing the amount owed or allowing for a more structured repayment schedule. The specific amount available for repayment will depend on the terms of the life insurance policy and the nature of the debtor’s debts. This allows for more flexible repayment options, providing a better chance for successful completion of the bankruptcy process.

Utilization of Proceeds in the Bankruptcy Plan

Life insurance proceeds can be a crucial element in satisfying creditor claims within a bankruptcy plan. The bankruptcy trustee, or a court-appointed official, will oversee how these funds are distributed, ensuring they are used according to the bankruptcy laws and the agreed-upon plan. The plan must clearly specify how the proceeds will be allocated, providing a transparent approach to handling these assets.

For instance, a plan might prioritize secured debts (like mortgages) before unsecured debts (like credit card balances).

Maximizing Use of Life Insurance Proceeds

To maximize the use of life insurance proceeds in a bankruptcy plan, debtors should consult with a bankruptcy attorney. This professional can help assess the value of the proceeds and determine the best way to incorporate them into the plan. Strategies might involve negotiating with creditors to modify existing repayment agreements or explore alternative repayment options. They will also assess the potential impact of the proceeds on the bankruptcy discharge and other legal implications.

Thorough legal counsel is essential for navigating the complexities of this process.

Negotiating a Bankruptcy Plan

Negotiating a bankruptcy plan that incorporates life insurance proceeds requires a detailed understanding of the applicable bankruptcy laws and regulations. The debtor and creditors must work collaboratively to create a fair and equitable plan that satisfies the needs of all parties involved. This includes open communication and a willingness to compromise, ensuring that the life insurance proceeds are used to the maximum benefit for all involved in the process.

A mediator or attorney can facilitate these negotiations to help achieve a mutually acceptable solution.

Practical Considerations and Recommendations: Chapter 7 And Life Insurance Proceeds

Navigating life insurance and Chapter 7 bankruptcy can be tricky, but understanding the practicalities can ease the process. Knowing how life insurance proceeds can be used strategically during bankruptcy, and planning ahead, are key. This section provides practical advice for Medan folks facing this situation.

Utilizing Life Insurance Proceeds During Bankruptcy

Life insurance proceeds can be a valuable tool for managing debts and expenses during bankruptcy. They can be used to pay off debts, cover living expenses, or even contribute to a fresh start. The key is to understand how the bankruptcy court views these funds and how to best utilize them.

- Debt Payment: Life insurance proceeds can be used to directly pay off unsecured debts, such as credit card bills or medical debt. This can significantly reduce the burden on the individual and potentially expedite the bankruptcy process.

- Living Expenses: In some cases, life insurance proceeds can be used to cover essential living expenses while the bankruptcy is ongoing. This helps maintain a stable financial footing during a challenging period.

- Rebuilding Credit: Utilizing proceeds responsibly can be a step towards rebuilding credit after bankruptcy. Demonstrating responsible financial management can be beneficial when applying for loans or credit cards in the future.

Planning for Potential Bankruptcy Situations

Proactively planning for potential bankruptcy scenarios involving life insurance is crucial. This includes understanding policy specifics and potential implications.

- Review Policy Terms: Understanding the policy’s terms, including the beneficiary designations, is vital. It’s essential to know how the proceeds will be handled in a bankruptcy situation. Ensure your beneficiaries are aware of these details too.

- Seek Legal Counsel: Consulting a bankruptcy attorney is essential. They can provide personalized advice on how to best manage life insurance proceeds within the bankruptcy framework. This is a crucial step to protect your interests and ensure compliance with the law.

- Communicate with Beneficiaries: Open communication with beneficiaries about potential bankruptcy implications is key. This will ensure transparency and prevent misunderstandings or conflicts later.

Importance of Legal Counsel

Seeking legal counsel regarding life insurance and bankruptcy is paramount. A bankruptcy attorney can provide critical guidance on how to navigate the legal complexities and protect your interests. They can help you understand your rights and responsibilities in the process.

Potential Issues and Solutions

| Potential Issue | Possible Solution |

|---|---|

| Life insurance proceeds are considered part of the bankruptcy estate. | Work with a bankruptcy attorney to understand how to utilize the proceeds without jeopardizing the claim. |

| Disputes arise over the beneficiary designation. | Ensure the beneficiary designation is clear and legally sound. Consider legal counsel to prevent potential conflicts. |

| Uncertainties about the tax implications of life insurance proceeds in bankruptcy. | Consult with a tax professional to understand the tax implications and plan accordingly. |

| Misunderstanding of the rights and obligations in bankruptcy. | Seek professional legal advice to understand the rights and obligations clearly. |

Final Summary

In conclusion, the intersection of Chapter 7 bankruptcy and life insurance proceeds presents a complex interplay of legal rights and obligations. This comprehensive guide provides a detailed understanding of the various facets involved, from protecting policy benefits to resolving disputes and maximizing the use of proceeds in bankruptcy plans. Ultimately, understanding these intricacies is crucial for both debtors and creditors to navigate this challenging legal landscape effectively.

General Inquiries

Can life insurance proceeds be claimed by creditors in a Chapter 7 bankruptcy?

The answer depends on several factors, including the type of policy, beneficiary designations, and applicable state laws. In some cases, creditors might have a claim, while in others, the proceeds are protected.

What types of life insurance policies are typically excluded from the bankruptcy estate?

Policies designated to specific beneficiaries and those where the policy owner is not the debtor are often excluded. The specific details vary by jurisdiction and policy type.

How can debtors protect their life insurance benefits from being part of the bankruptcy estate?

Proper beneficiary designations and keeping the policy separate from other assets can help. Legal counsel is essential to tailor strategies to specific situations.

What are the common reasons for disputes over life insurance proceeds in a Chapter 7 bankruptcy?

Disputes often arise regarding the validity of creditor claims, beneficiary designations, and the proper application of legal frameworks in different jurisdictions. These can lead to lengthy and complex court proceedings.