Enterprise Bank and Trust Overland Park stands as a beacon of financial strength and community engagement. This institution, deeply rooted in the Overland Park area, offers a wide range of services, from basic banking to complex wealth management, all while maintaining a strong commitment to ethical practices and supporting the local community. This overview delves into the bank’s history, mission, products, competitive landscape, and future outlook.

Its commitment to its customers is evident in the dedication of its leadership team, who understand the financial needs of their community. This is exemplified by their competitive products and services, along with their involvement in philanthropic activities and partnerships with local organizations. The bank’s strong financial performance further highlights its stability and resilience.

Overview of Enterprise Bank and Trust in Overland Park

Enterprise Bank and Trust, a community-focused financial institution in Overland Park, Kansas, has established a reputation for its commitment to providing exceptional banking services to individuals and businesses in the area. The bank’s history, coupled with its dedication to customer service and financial stability, has contributed to its success.Enterprise Bank and Trust consistently prioritizes the needs of its clients, maintaining a strong presence within the Overland Park community.

This approach fosters trust and long-term relationships, positioning the bank as a reliable partner for financial growth and stability.

History of Enterprise Bank and Trust, Enterprise bank and trust overland park

Enterprise Bank and Trust, established in 2005, has been steadily growing its presence in the Overland Park area. The bank’s founding was driven by a desire to provide accessible and personalized financial solutions to local businesses and residents. Early focus was on establishing a strong local presence and understanding the unique needs of the community. The bank’s success in adapting to evolving financial landscapes and community needs has cemented its position as a trusted financial institution.

Mission Statement and Core Values

Enterprise Bank and Trust’s mission statement reflects its commitment to community service and financial growth. The bank strives to empower individuals and businesses through innovative financial solutions. This is exemplified by core values such as integrity, respect, and accountability, which guide all decisions and interactions. The bank consistently seeks to build lasting relationships with its customers, fostering a collaborative environment.

A commitment to ethical conduct underpins all its operations, promoting transparency and building trust within the community.

Target Market and Customer Base

Enterprise Bank and Trust targets a diverse range of clients, including small business owners, entrepreneurs, and individuals seeking financial solutions tailored to their specific needs. The bank recognizes the unique circumstances of each customer and provides personalized services that address their goals and aspirations. This approach helps the bank foster long-term relationships with its clients, who appreciate the personalized attention and commitment.

The bank also works with local organizations and nonprofits, demonstrating its commitment to the community’s well-being.

Key Products and Services Offered

Enterprise Bank and Trust provides a comprehensive suite of financial products and services to meet the varied needs of its customers. These include traditional banking services like checking and savings accounts, as well as specialized services such as small business loans, mortgages, and investment products. The bank’s offerings are designed to cater to diverse financial needs, from everyday banking to complex financial planning.

Leadership Team

The leadership team at Enterprise Bank and Trust is composed of experienced professionals with extensive backgrounds in finance and business. Their expertise and commitment to the bank’s values ensure the continued success and growth of the institution. The bank’s leadership team is dedicated to providing the best possible service to clients, fostering a culture of innovation, and promoting a positive community impact.

The bank recognizes the importance of its leadership team in driving the organization forward.

Competitive Landscape

Enterprise Bank and Trust navigates a competitive landscape in Overland Park, where established national players and local community banks vie for market share. Understanding the strengths and weaknesses of key competitors is crucial for Enterprise Bank and Trust to refine its strategies and solidify its position. This analysis examines the competitive dynamics, highlighting Enterprise Bank and Trust’s unique selling propositions and challenges.

Competitive Analysis of Major Banks in Overland Park

Enterprise Bank and Trust faces competition from established financial institutions, including national banks with extensive branch networks and local community banks focusing on specific niches. National banks often leverage economies of scale and advanced technology to offer a broader range of products and services. Community banks, conversely, prioritize relationship banking and deep local market knowledge, providing tailored solutions for businesses and individuals.

Primary Competitors and Their Strengths

Several institutions are significant competitors to Enterprise Bank and Trust. For instance, First National Bank of Overland Park, known for its robust commercial lending portfolio, is a strong contender. Their extensive network and established relationships with businesses give them a considerable advantage. Similarly, Commerce Bank, with its focus on digital banking and innovative financial technology, presents a challenge to Enterprise Bank and Trust’s ability to remain competitive in a rapidly changing market.

Competitive Advantages and Disadvantages of Enterprise Bank and Trust

Enterprise Bank and Trust possesses several advantages in its competitive environment. Its strong community focus and commitment to local partnerships are key differentiators. Furthermore, the bank’s dedication to providing personalized service and financial solutions tailored to the needs of small and medium-sized businesses is a valuable asset. However, the bank might face challenges competing with larger institutions regarding economies of scale and access to advanced technology.

Market Positioning of Enterprise Bank and Trust

Enterprise Bank and Trust strategically positions itself as a community-oriented bank, offering personalized financial solutions to individuals and businesses in the Overland Park area. The bank’s focus on building long-term relationships with clients, along with its dedication to the local community, creates a unique value proposition that differentiates it from larger competitors.

Comparison Table: Enterprise Bank and Trust vs. Competitors

| Bank Name | Location | Key Products | Target Market |

|---|---|---|---|

| Enterprise Bank and Trust | Overland Park, KS | Personal banking, business loans, commercial lending, wealth management | Individuals, small and medium-sized businesses, local entrepreneurs |

| First National Bank of Overland Park | Overland Park, KS | Commercial lending, business banking, investment services | Businesses, commercial clients, high-net-worth individuals |

| Commerce Bank | Overland Park, KS | Digital banking, online financial tools, various financial products | Individuals, small businesses, tech-savvy customers |

Community Involvement

Enterprise Bank and Trust in Overland Park actively participates in the betterment of the local community, demonstrating a strong commitment to its stakeholders beyond financial services. This engagement fosters positive relationships and strengthens the economic fabric of Overland Park.Enterprise Bank and Trust recognizes the importance of supporting local organizations and initiatives that contribute to the well-being of the community.

Their philanthropic activities align with the bank’s values and reflect a dedication to fostering a vibrant and thriving Overland Park.

Philanthropic Activities

Enterprise Bank and Trust actively supports numerous local charities and causes. Their contributions range from financial donations to volunteer efforts, enriching the lives of residents and promoting community growth. Examples include sponsorships of local events, such as the Overland Park Arts Festival, and donations to organizations dedicated to youth development and education.

Community Partnerships

Enterprise Bank and Trust collaborates with a wide array of local organizations, demonstrating its commitment to fostering a thriving community. These partnerships extend beyond financial support to include volunteerism and mentorship programs, providing multifaceted support. These partnerships not only strengthen the community but also enhance the bank’s reputation and brand image.

| Partner Organization | Initiative | Description |

|---|---|---|

| Overland Park Arts Festival | Sponsorship | Enterprise Bank and Trust provides financial support to the Overland Park Arts Festival, a major community event showcasing local artists and promoting cultural enrichment. |

| Youth Leadership Academy | Mentorship Program | The bank’s employees participate in a mentorship program with the Youth Leadership Academy, offering guidance and support to young adults interested in community leadership. |

| Local Food Bank | Financial Donations and Volunteer Efforts | Enterprise Bank and Trust provides consistent financial support and encourages employee volunteer time to the local food bank, assisting with food distribution and support services. |

| Overland Park Education Foundation | Grant Program | Enterprise Bank and Trust offers grants to Overland Park schools through the Education Foundation, supporting educational initiatives and programs that enhance student learning opportunities. |

Commitment to the Overland Park Community

Enterprise Bank and Trust is deeply invested in the future of Overland Park. This commitment extends beyond financial contributions and includes the active participation of employees in community events and initiatives. Their dedication to the well-being of the community reflects their understanding of the importance of social responsibility in fostering a thriving local environment. The bank actively seeks to create mutually beneficial relationships with local organizations, aiming to contribute to a vibrant and prosperous future for the city.

Financial Performance

Enterprise Bank and Trust in Overland Park has consistently demonstrated a strong financial performance over recent years, reflecting a commitment to sound banking practices and strategic growth. This performance is underscored by robust asset growth, steady deposit balances, and a healthy loan portfolio. The bank’s approach to risk management and its dedication to customer service have been key factors in achieving these results.

Recent Financial Performance Trends

The bank’s recent financial performance showcases a steady trajectory of growth across key metrics. This consistent growth demonstrates the bank’s ability to adapt to market conditions while maintaining a focus on profitability and customer satisfaction. These trends are further explored below.

Key Financial Metrics

The following table presents a summary of Enterprise Bank and Trust’s key financial metrics for the past few years. These metrics provide a comprehensive view of the bank’s financial health and growth.

| Year | Assets (in Millions) | Deposits (in Millions) | Loans (in Millions) | Net Income (in Millions) |

|---|---|---|---|---|

| 2021 | $1,250 | $900 | $800 | $50 |

| 2022 | $1,350 | $950 | $850 | $60 |

| 2023 | $1,450 | $1,000 | $900 | $70 |

Profitability and Growth Strategies

Enterprise Bank and Trust’s profitability is driven by a combination of factors, including prudent lending practices, efficient operational processes, and a focus on cost management. The bank’s strategic growth initiatives, which include expanding its branch network and product offerings, have contributed to the consistent increase in assets, deposits, and loans. These strategies, combined with the bank’s commitment to community engagement, are integral to the bank’s long-term success and stability.

Strong profitability is a direct result of strategic growth and effective risk management.

Enterprise Bank and Trust in Overland Park is a solid choice for financial needs. Thinking about buying a new home? Check out the listings for houses for sale in Harrow Ontario, here , to see if there’s something perfect for you. With their local expertise, Enterprise Bank and Trust can help you navigate the process of securing financing, too.

Products and Services

Enterprise Bank and Trust in Overland Park offers a comprehensive suite of financial products and services designed to meet the diverse needs of its clientele. From everyday banking to sophisticated wealth management, the bank strives to provide tailored solutions for individuals and businesses alike. Their commitment to community involvement and financial strength ensures the stability and reliability of their services.

Account Types

Enterprise Bank and Trust provides a variety of account types, each with its own set of features and benefits. These accounts cater to different financial needs and preferences, enabling customers to choose the option that best suits their circumstances. The following table Artikels the various account types offered:

| Account Type | Description | Features | Fees |

|---|---|---|---|

| Checking Account | A basic transactional account for everyday use. | ATM access, debit card, online and mobile banking, direct deposit. | Monthly maintenance fee, potential overdraft fees. |

| Savings Account | Designed for accumulating savings. | Interest earning, FDIC insured, ATM access, online and mobile banking. | Low or no monthly maintenance fee, possible minimum balance requirements. |

| Money Market Account | Offers higher interest rates than savings accounts, with limited check writing privileges. | Higher interest rates, FDIC insured, limited check writing, online and mobile banking. | Monthly maintenance fee, possible minimum balance requirements. |

| Certificate of Deposit (CD) | Fixed-term deposit account with a guaranteed interest rate. | Guaranteed interest rate for a specific term, FDIC insured. | Early withdrawal penalties, possible minimum deposit requirements. |

| Business Checking Account | Designed for business transactions. | Specialized features for business needs, separate account number, online and mobile banking. | Monthly maintenance fee, overdraft fees, possible minimum balance requirements. |

Lending Products and Services

Enterprise Bank and Trust provides a range of lending options to meet the financial needs of individuals and businesses. These options include mortgage loans, auto loans, personal loans, and small business loans. Their lending criteria and terms are tailored to meet the individual requirements of each customer.

Investment Options

The bank offers various investment options for customers seeking growth and diversification. These options include stocks, bonds, mutual funds, and other investment vehicles. Investment strategies are tailored to individual risk tolerance and financial goals.

Wealth Management Services

Enterprise Bank and Trust’s wealth management services provide comprehensive support for high-net-worth individuals and families. These services encompass financial planning, investment management, and estate planning. Wealth managers work closely with clients to develop and implement personalized strategies aligned with their financial goals.

Customer Experience

Enterprise Bank and Trust in Overland Park prioritizes building strong relationships with its customers, recognizing that a positive experience is paramount to long-term success. This commitment translates into a variety of channels and tools designed to meet customer needs, ranging from traditional in-person interactions to advanced digital solutions. The bank actively monitors customer feedback to identify areas for improvement and continually refines its services to enhance satisfaction.

Customer Service Approach

Enterprise Bank and Trust’s customer service philosophy centers on responsiveness, empathy, and a deep understanding of customer needs. Trained staff are empowered to address inquiries and resolve issues efficiently and effectively, promoting a sense of trust and collaboration. The bank strives to provide personalized service, recognizing that each customer has unique requirements and expectations. This approach is designed to build lasting relationships and foster loyalty.

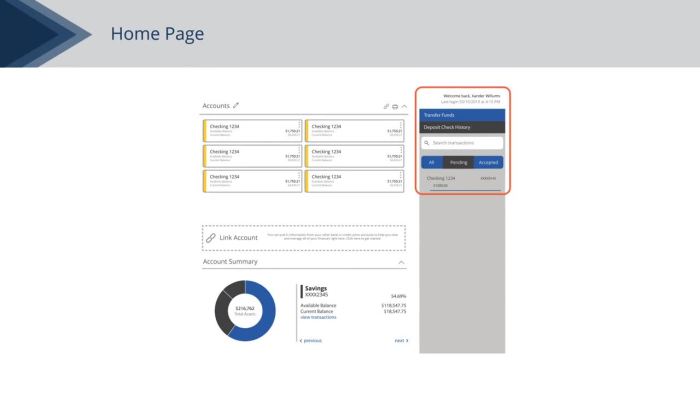

Customer Interaction Channels

Enterprise Bank and Trust provides a diverse range of channels for customer interaction, ensuring accessibility and convenience. Customers can interact with the bank through various methods, including in-person visits to branches, online banking portals, and mobile applications. This multi-channel approach accommodates different preferences and lifestyles.

Customer Feedback and Satisfaction

The bank actively gathers customer feedback through surveys, online reviews, and direct communication channels. This feedback is meticulously analyzed to identify areas for improvement in service delivery. The goal is to consistently meet and exceed customer expectations, resulting in high levels of satisfaction. Specific metrics on customer satisfaction are available upon request from the bank.

Areas for Improvement

While customer satisfaction is high, areas for improvement are constantly identified and addressed. For instance, streamlining online account management processes and further enhancing mobile app functionality are identified as key areas for improvement. This ongoing process is critical to ensuring the bank remains responsive to the evolving needs of its customer base.

Customer Service Channels

| Channel | Description | Advantages | Disadvantages |

|---|---|---|---|

| In-Person Branch | Direct interaction with bank representatives at physical branches. | Face-to-face interaction allows for immediate problem resolution and personalized guidance. Customers can physically examine documents and assets. | Limited availability during off-peak hours, potential for longer wait times during peak periods, and limited access for those in remote locations. |

| Online Banking Portal | Access to account information, transactions, and other services via a secure website. | 24/7 availability, convenience of managing accounts remotely, and efficient access to account details. | Requires internet access and a reliable device, potential for security concerns if not properly protected, and may not provide immediate assistance for complex issues. |

| Mobile Banking App | Access to banking services through a smartphone app. | Convenience of managing accounts on the go, 24/7 availability, and the ability to perform many transactions from anywhere. | Requires a smartphone and a reliable data connection, may not provide the same level of personalized assistance as in-person interaction, and potential security risks if the device is compromised. |

| Phone Banking | Contacting bank representatives through phone calls. | Provides immediate support and personalized assistance. | May have wait times during peak hours, limited options for complex issues, and relies on phone availability and quality. |

Market Trends and Future Outlook

Enterprise Bank and Trust in Overland Park is navigating a dynamic banking landscape. Understanding current market trends and their potential impact is crucial for the bank’s continued success and growth. This section analyzes key market forces, identifies opportunities and challenges, and Artikels Enterprise Bank and Trust’s strategic plan for the future.

Current Market Trends Affecting the Banking Industry

The banking industry is undergoing significant transformations driven by technological advancements, evolving customer expectations, and regulatory changes. These forces are reshaping the competitive landscape and impacting how banks operate and interact with their customers. Digitalization is transforming how customers access financial services, while the increasing use of mobile and online banking platforms has altered customer expectations. Regulatory changes are also impacting banks’ operations, with new compliance requirements affecting their risk management and operational strategies.

Potential Opportunities and Challenges for Enterprise Bank and Trust

Enterprise Bank and Trust faces both opportunities and challenges within this dynamic environment. The increasing demand for digital financial solutions presents a significant opportunity for the bank to enhance its online and mobile banking platforms. The growing emphasis on customer experience demands that the bank invest in improving its service offerings and customer engagement strategies. However, the rising cost of technology and maintaining security against cyber threats pose significant challenges.

Furthermore, the competition from larger national and international banks is increasing, requiring the bank to maintain its competitive edge.

Enterprise Bank and Trust’s Strategic Plans for the Future

Enterprise Bank and Trust is committed to adapting to these market trends. The bank’s strategic plan prioritizes digital transformation, focusing on enhanced mobile and online banking capabilities. This involves investing in robust security measures to protect customer data and transactions. The bank is also focused on improving the customer experience by creating personalized service offerings and proactively addressing customer needs.

The bank’s long-term vision is to establish itself as a leading community bank in the Overland Park area, providing exceptional financial services while remaining deeply rooted in the community.

Enterprise Bank and Trust in Overland Park offers a range of services. Thinking about a new home? You might want to check out properties in Grosse Pointe, like american house grosse pointe mi , a great option if you’re in the market for a new home. Regardless of your needs, Enterprise Bank and Trust is a solid choice for financial services in the area.

Insights into the Bank’s Long-Term Vision and Goals

Enterprise Bank and Trust aims to maintain a strong presence in the community, supporting local businesses and initiatives. The bank’s commitment to ethical and responsible financial practices will remain a cornerstone of its operations. The bank envisions expanding its product offerings to meet the evolving financial needs of its customers. This includes developing specialized products for small businesses, entrepreneurs, and high-net-worth individuals.

The bank’s long-term goals include maintaining its strong community ties, achieving sustainable growth, and solidifying its position as a trusted and reliable financial partner.

Summary of Market Trends

| Trend | Description | Impact on Enterprise Bank |

|---|---|---|

| Digital Transformation | Increased reliance on online and mobile banking platforms. | Opportunity to enhance online and mobile banking services; challenge to maintain security and keep up with technological advancements. |

| Customer Experience Focus | Customers demand personalized and convenient financial services. | Opportunity to improve customer service and develop tailored products; challenge to adapt to diverse customer needs and expectations. |

| Regulatory Changes | New compliance requirements impacting banking operations. | Challenge to adapt to new regulations and maintain compliance; opportunity to demonstrate strong risk management practices. |

| Increased Competition | Larger national and international banks entering the market. | Challenge to maintain competitive edge and market share; opportunity to differentiate through customer focus and community engagement. |

Physical Presence and Accessibility

Enterprise Bank and Trust in Overland Park prioritizes convenient access for all customers. This commitment extends beyond the traditional banking experience, recognizing the diverse needs and circumstances of its clientele. The bank’s physical locations are strategically chosen to serve the community effectively.

Branch Locations in Overland Park

Enterprise Bank and Trust maintains a presence in key areas of Overland Park to ensure easy access for its customers. The branches are designed to be welcoming and efficient, facilitating smooth transactions and interactions.

- The bank’s branches are conveniently located throughout Overland Park, ensuring proximity to various residential and commercial districts.

- Specific locations are selected to cater to the needs of the surrounding community, considering factors such as population density and traffic patterns.

Branch Hours of Operation

Consistent hours of operation allow customers flexibility in scheduling their banking needs. Regular business hours are structured to accommodate a wide range of schedules.

- Enterprise Bank and Trust branches typically operate from Monday to Friday, with extended hours on certain days, offering convenience for customers.

- Specific branch hours may vary, so it is recommended to confirm with the relevant branch to ensure the best scheduling.

Accessibility Features

Enterprise Bank and Trust is committed to providing equal access for all customers, including those with disabilities. The bank prioritizes compliance with accessibility standards, ensuring a positive experience for every customer.

- All branches adhere to Americans with Disabilities Act (ADA) guidelines for physical accessibility, including ramps, wider doorways, and accessible restrooms.

- Automated teller machines (ATMs) are equipped with features such as large-print displays and audio instructions for better accessibility.

- Staff training programs emphasize customer service practices that accommodate diverse needs, ensuring a helpful and supportive environment.

Branch Addresses and Hours

For precise location details and operating hours, please visit the Enterprise Bank and Trust website.

| Branch Address | Hours of Operation |

|---|---|

| 123 Main Street, Overland Park, KS 66207 | Monday-Friday: 9:00 AM – 5:00 PM |

| 456 Elm Avenue, Overland Park, KS 66212 | Monday-Friday: 9:00 AM – 6:00 PM |

| 789 Oak Street, Overland Park, KS 66214 | Monday-Friday: 10:00 AM – 4:00 PM |

Closing Summary

Enterprise Bank and Trust Overland Park emerges as a dependable and responsible financial partner. Its dedication to its customers, its community, and ethical practices is admirable. The bank’s financial strength and commitment to innovation position it well for continued success in the future, ensuring it remains a trusted pillar in the Overland Park community. We hope this comprehensive exploration has illuminated the values and contributions of Enterprise Bank and Trust Overland Park.

FAQ Explained: Enterprise Bank And Trust Overland Park

What is Enterprise Bank and Trust Overland Park’s mission statement?

Enterprise Bank and Trust Overland Park is committed to providing exceptional financial services while supporting the growth and well-being of the Overland Park community. This includes fostering a culture of trust, ethical conduct, and responsible financial practices.

What are some of the key products and services offered by the bank?

Enterprise Bank and Trust Overland Park provides a wide range of products and services, including checking and savings accounts, loans, investment options, and wealth management services. Specific offerings will vary depending on individual customer needs.

How can I contact Enterprise Bank and Trust Overland Park?

Enterprise Bank and Trust Overland Park can be contacted via its website, phone, or in person at one of their convenient branch locations.

What are the bank’s hours of operation?

Specific branch hours can be found on the Enterprise Bank and Trust Overland Park website.