Auto insurance letter of experience: Navigating the complexities of your driving history and insurance application. This comprehensive guide unveils the secrets to crafting a compelling letter that showcases your responsible driving habits, ensuring a smooth and successful insurance process. From understanding the nuances of a letter of experience to addressing specific situations like accidents or violations, this resource is your essential companion for a positive outcome.

This guide will provide a detailed explanation of what an auto insurance letter of experience entails, offering practical examples and templates. We’ll delve into crucial aspects, including the structure, content considerations, and legal implications, to help you present your driving history effectively.

Understanding the Letter of Experience

A letter of experience for auto insurance provides a detailed account of your driving history and claims experience to the insurance company. It’s a crucial document, often requested to assess your risk profile and determine your premium. This letter helps insurers understand your driving habits and the likelihood of future claims.This document acts as a comprehensive record of your driving history, highlighting factors relevant to insurance evaluation.

It goes beyond simply stating whether you have had accidents or claims. It also explains the context, circumstances, and any lessons learned from past incidents. It’s a way to demonstrate responsible driving habits and help the insurer assess your risk appropriately.

What Constitutes a Letter of Experience

A letter of experience for auto insurance is a formal document outlining your driving history. It typically details your driving record, including any accidents, claims, violations, and incidents that may affect your insurability. It’s more than just a summary; it’s a narrative explaining the circumstances surrounding each event. This narrative approach allows the insurer to understand the context and impact of past experiences.

Situations Requiring a Letter of Experience

A letter of experience is frequently requested in various situations. These include:

- Applying for a new auto insurance policy:

- Changing insurance providers:

- Updating your existing policy:

- Adjusting insurance rates:

- Claims Investigation:

This is a common scenario where insurers need a comprehensive understanding of your driving record to determine your premium. A detailed letter of experience allows them to make an informed decision based on your entire history.

Switching insurance companies often requires a letter of experience. This allows the new insurer to assess your risk and determine the appropriate coverage and premium.

When updating or modifying your existing policy, a letter of experience can be required to reflect changes in your driving habits or circumstances.

Insurers might request a letter of experience when adjusting your premiums. This helps to understand the reasons behind any changes in your driving record.

In the event of a claim, the insurance company may request a letter of experience to gather additional context about the situation. This can include the reason for the claim and details about how the incident occurred.

Reasons for Insurer Requests

Insurers request letters of experience to gain a comprehensive understanding of your driving history and assess your risk profile. This helps them in several ways:

- Determining the appropriate premium:

- Evaluating claims history:

- Understanding driving habits:

- Assessing accident causes:

- Determining your risk profile:

Past driving experience significantly impacts the premium. A letter of experience allows the insurer to evaluate risk factors and set an appropriate premium.

This helps them assess the frequency and severity of past claims, understanding any patterns or recurring issues.

The letter can provide insight into your driving behavior, such as defensive driving practices, accident avoidance strategies, and overall responsibility on the road.

This allows insurers to understand the causes of any accidents, which aids in determining the likelihood of future accidents.

By providing a detailed account of your driving history, you provide crucial data for insurers to assess your risk and set a fair premium.

Importance of Accuracy and Completeness

Accuracy and completeness are paramount in a letter of experience. Providing an accurate account of your driving history helps the insurer make an informed decision about your risk profile. Inaccurate or incomplete information can lead to a denial of coverage or incorrect premium calculation. This impacts your ability to get coverage or the cost of that coverage.

Information Typically Included

A letter of experience for auto insurance typically includes the following information:

- Personal Information:

- Driving History:

- Insurance History:

- Explanation of Events:

- Contact Information:

This includes your name, address, date of birth, and driver’s license number.

A detailed record of any accidents, claims, violations, and incidents. This should include dates, locations, and descriptions of the events.

Details of your past insurance policies, including insurers, policy numbers, and premium amounts.

Provide a clear explanation of the circumstances surrounding any accidents, claims, or violations. Include any contributing factors and any lessons learned.

Your phone number and email address for easy communication.

Structure and Format: Auto Insurance Letter Of Experience

A letter of experience for auto insurance demonstrates your driving history and responsible insurance practices. This structured format clearly communicates your experience and helps insurance providers assess your risk profile. A well-organized letter can significantly impact your premium rates.A well-structured letter of experience provides a concise and easily digestible summary of your driving history and insurance record. This allows insurance providers to quickly and efficiently assess your risk profile, leading to a more informed decision about your insurance premium.

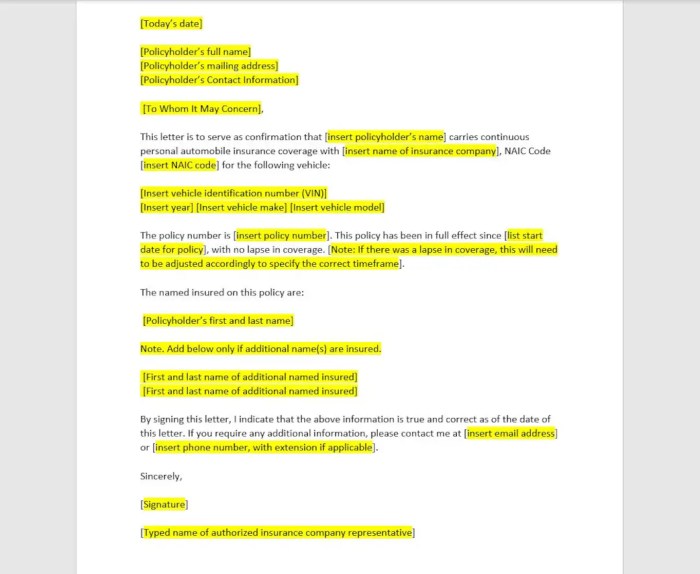

Letter Template

This template provides a structured approach to presenting your driving history and insurance experience, which is beneficial for insurance providers. It ensures a clear and concise presentation of your experience.

Key Details:

- Personal Information: Include your full name, current address, phone number, and email address. This section establishes your identity and contact details.

- Driving History: Detail your accident history, traffic violations, and any insurance claims. For example, if you have no accidents or violations, explicitly state this. If you have any claims, provide a brief description. This section gives insight into your driving habits.

- Vehicle Details: Include the make, model, and year of the vehicles you have insured. Highlight the period you’ve been insured for each vehicle. For example, specify if the vehicle has been insured since 2018.

- Insurance History: Summarize your insurance history with details of the insurance providers you’ve used and the duration of coverage with each provider. Provide the policy numbers for clarity. Mention any premium adjustments or discounts you received.

- Additional Information: Include any relevant information that might influence your insurance experience, such as participation in defensive driving courses or any other relevant details. For example, mentioning a commitment to safe driving practices can be advantageous.

Section Breakdown

This table Artikels the different sections of the letter and their corresponding information.

| Section | Description | Example Data |

|---|---|---|

| Personal Information | Name, address, contact details | John Doe, 123 Main St, Anytown, CA 91234, (555) 123-4567, john.doe@email.com |

| Driving History | Accidents, violations, claims | No accidents, no violations, no claims |

| Vehicle Details | Make, model, year, insurance history | Toyota Camry, 2018, Insured since 2018, Policy #123456 |

| Insurance History | Insurance providers, duration, policy numbers, premium adjustments | XYZ Insurance Company, 2018-2023, Policy #123456, No premium adjustments |

| Additional Information | Defensive driving courses, safety awards | Completed a defensive driving course in 2022, Awarded “Safe Driver” certificate in 2023 |

Using Bullet Points and Numbered Lists

Using bullet points and numbered lists effectively can make the letter more concise and easier to read. For instance, a numbered list can be used to present accidents chronologically. A bulleted list can highlight positive driving experiences like participating in defensive driving courses.

Example using bullet points:

- Maintained a clean driving record for the past five years.

- Participated in a defensive driving course in 2022.

- Have been a loyal customer of ABC Insurance for the past seven years.

Content Considerations

A compelling letter of experience for auto insurance requires careful consideration of your driving history and habits. This section provides guidance on effectively presenting your driving record and relevant details to paint a positive picture of your responsible behavior.Presenting a detailed and accurate account of your driving history is crucial to demonstrating your responsible behavior and minimizing any potential concerns.

It’s vital to be honest and transparent while emphasizing the positive aspects of your driving record.

Describing Driving Habits and Behaviors

Presenting a clear and concise description of your driving habits is essential for showcasing responsible behavior. This includes highlighting your attentiveness, defensive driving techniques, and commitment to road safety.

- Focus on proactive measures you’ve taken to avoid accidents, such as maintaining a safe following distance, using your turn signals, and avoiding distractions. Examples include consistent use of hands-free devices and avoiding speeding.

- Emphasize your consistent adherence to traffic laws and regulations. Mention any relevant safety courses or training programs you’ve completed, like defensive driving classes, and how these have influenced your driving style.

- Describe any specific strategies you’ve employed to mitigate risks, such as planning routes to avoid congested areas or taking breaks during long drives to maintain alertness.

Presenting Claims History (If Any)

Handling claims history, if any, requires a delicate approach. Honesty and transparency are paramount, but framing the circumstances in a positive light is also crucial.

Wah, auto insurance letter of experience tuh penting banget, kayak KTP. Soalnya kalo mau ngurusin ini-itu, perlu banget bukti pengalaman. Nah, kalo lagi bingung nyari informasi tentang food stamp office di Denton Texas, mending cek di sini food stamp office in denton texas. Meskipun beda urusan, tapi tetep penting buat dapetin info yang bener, kan?

Jadi, tetep fokus sama surat pengalaman asuransi mobil kita, ya. Kalo udah dapet, baru deh kita lanjutin urusannya.

- Clearly and concisely explain any past claims, providing factual details without exaggerating or minimizing the circumstances. For example, if a minor fender bender occurred due to another driver’s negligence, emphasize this fact.

- Highlight any lessons learned from past experiences. Show how you’ve adjusted your driving habits to prevent similar incidents from recurring. For example, describe how you’ve improved your situational awareness and risk assessment.

- If possible, include documentation such as police reports or insurance claim information to support your account. This adds credibility and provides a clear and factual record.

Presenting Accidents or Violations

Accidents or violations, if present, should be presented in a manner that is understandable and does not mislead the insurance company.

- Present the details of any accidents or violations factually and objectively. Avoid emotional language or subjective interpretations. For example, use neutral terms like “minor collision” instead of “serious accident.” Include dates, locations, and parties involved.

- Explain the circumstances surrounding the event in a calm and objective manner. Focus on what you did to mitigate the situation, or what you learned from the incident to avoid future incidents. For example, highlight the steps you took to avoid a potential collision with another vehicle.

- If applicable, emphasize any steps taken to resolve the situation or the outcome. If you’ve taken measures to address any problems or learned from the experience, mention this to showcase your commitment to responsible driving. This includes any repairs or payments made to rectify the situation.

Emphasizing Safe Driving Practices and Responsible Behavior

Demonstrating safe driving practices and responsible behavior strengthens your application.

- Highlight any recent improvements in your driving habits, such as adopting a more defensive driving approach, using technology for navigation to avoid distractions, or taking refresher courses.

- Describe your consistent commitment to safe driving. Include examples of specific actions you’ve taken to prevent accidents, such as adjusting your driving style in adverse weather conditions or avoiding distractions like cell phone use.

- Show that you value safe driving through proactive actions. Emphasize any safety features or measures you’ve adopted to enhance your driving, like using GPS navigation systems to avoid unfamiliar roads or installing dashcams for safety.

Explaining Prior Insurance Policies or Changes in Coverage

Providing clarity on prior insurance policies and any coverage changes is important.

Wah, auto insurance letter of experience tuh penting banget, kayak bikin proposal buat dapetin asuransi mobil. Gue sih, kalo lagi mikirin itu, suka kepikiran juga soal pizza vegan deep dish dari Chicago. Enak banget, tuh, teksturnya crispy di luar, lembut di dalam, kayak asuransi yang bagus, harusnya gitu juga. Chicago vegan pizza deep dish emang juara! Pokoknya, surat pengalaman asuransi mobil ini harus rapi dan jelas, biar dapet asuransi yang oke banget.

- Clearly explain any previous insurance policies, including the insurance company, policy duration, and any changes in coverage. This includes dates of coverage, reasons for any policy changes, and the insurer.

- If you’ve had multiple policies, provide details of each policy to demonstrate a history of responsible insurance practices. For example, provide the insurer and the duration of each policy.

- Explain any changes in coverage or circumstances that might have influenced your insurance needs. If you’ve moved or changed jobs, highlight these changes and their impact on your coverage requirements.

Illustrative Examples

This section provides detailed examples of letters of experience for various auto insurance scenarios. These examples showcase how to effectively communicate driving history and experiences while maintaining a professional and concise tone. Each example demonstrates a different approach to presenting information to the insurance company.

Positive Letter for Clean Driving Record, Auto insurance letter of experience

This letter highlights the applicant’s exemplary driving record, emphasizing their commitment to safe driving practices. It builds a strong case for a favorable insurance rate.

“I am writing to provide information regarding my driving history for [Insurance Company Name]. I have held a valid driver’s license for [Number] years and have consistently maintained a clean driving record. I have never been involved in any accidents or received any traffic violations. I am committed to safe driving practices and prioritize responsible road use.”

Addressing a Minor Traffic Violation

This example demonstrates how to address a minor traffic violation without jeopardizing the application. It focuses on acknowledging the infraction while emphasizing the overall responsible driving behavior.

“I am writing to provide information regarding a minor traffic violation I received on [Date] for [Description of violation]. This was a [brief explanation of the violation, e.g., minor speeding infraction]. Since that time, I have been even more vigilant in my adherence to traffic laws. My driving record reflects my commitment to safe driving practices and my consistent responsible behavior.”

Explaining a Previous Claim

This example shows how to explain a previous claim in a clear and straightforward manner. It acknowledges the claim while emphasizing the lessons learned and subsequent improvements in driving behavior.

“I am writing to explain a previous claim filed on [Date] for [Brief description of claim, e.g., minor fender bender]. The incident involved [brief description of events]. Since then, I have been even more mindful of my driving habits, particularly [specific aspect of driving that was improved, e.g., maintaining safe following distances]. This incident has reinforced my commitment to safe driving practices.”

Emphasizing Responsible Driving Habits and Safe Practices

This letter demonstrates how to highlight responsible driving habits and safe practices. It showcases proactive measures taken to maintain a high standard of driving.

“I am writing to emphasize my commitment to responsible driving habits and safe practices. I regularly engage in defensive driving techniques and have taken various safety courses to further enhance my driving skills. I prioritize maintaining safe distances, using my turn signals, and adhering to all traffic laws. I am committed to continuously improving my driving skills and demonstrating responsible behavior on the road.”

Addressing Specific Situations

A letter of experience for auto insurance provides a valuable opportunity to present your driving history and circumstances in a positive light. This section details how to address various situations, from accidents and violations to changes in coverage or driving habits, to increase your chances of obtaining favorable insurance rates.Accurately and honestly describing your experience is crucial. Transparency and clarity are key to building trust with the insurance provider.

This approach helps avoid misunderstandings and allows the provider to make an informed decision regarding your application.

Handling Accidents and Violations

Accidents and violations, while unfortunate, can be addressed in a letter of experience. It is important to present the context and circumstances surrounding these events. Providing a concise and factual account of the incident, including details like the date, location, and nature of the accident, is recommended. Acknowledging any responsibility is important, but framing the situation in a way that minimizes its impact on your driving record is key.

- Clearly state the date and nature of any accidents or violations. Avoid overemphasizing minor incidents. Instead, focus on demonstrating responsible behavior, such as cooperation with authorities and reporting the accident promptly.

- If you were at fault, acknowledge your responsibility, and explain any mitigating circumstances that may have contributed to the incident. For example, bad weather conditions, mechanical failure, or unforeseen circumstances can be mentioned.

- If you were not at fault, provide supporting documentation like police reports or witness statements. Explain how you cooperated with authorities and took steps to resolve the situation.

Addressing Claims History

A history of claims can impact insurance rates. However, highlighting positive aspects, such as prompt reporting and cooperation with the insurance company, can mitigate the negative effects. Provide clear details about the claims, their resolutions, and any learning or preventative measures you took as a result.

- Present your claims history in a structured manner, detailing the date, nature, and resolution of each claim. Prioritize clarity and conciseness.

- Focus on any positive aspects of your claims history. Did you report the claim promptly? Did you cooperate fully with the insurance company? Emphasize these actions.

- Explain any lessons learned or preventative measures taken to avoid similar incidents in the future. For example, if a claim was related to a faulty part, highlight steps you took to ensure maintenance or repair.

Handling Changes in Coverage or Moving

Changes in insurance coverage or moving to a new location should be explicitly addressed in your letter of experience. Providing details about the changes and the reasons behind them is vital. Highlighting any changes in driving habits or circumstances is essential to ensuring the insurance company understands your current situation.

- Clearly state the dates of any changes in coverage, such as increasing or decreasing the amount of coverage, adding additional drivers, or changing the vehicle.

- Provide reasons for any changes in coverage, such as life changes, financial considerations, or a need for different levels of coverage. For example, moving to a new location with a lower risk of accidents can be cited.

- Explain any changes in your living situation, such as moving to a new location or a change in the type of dwelling.

Explaining Changes in Driving Habits or Circumstances

Changes in driving habits or circumstances can impact your insurance premium. Provide a detailed account of these changes, highlighting any improvements in driving behavior or increased safety precautions. Transparency in these changes allows the insurance company to assess the impact on your risk profile.

- Describe any changes in your driving habits, such as increased driving experience, participation in driver training programs, or a reduction in driving frequency.

- Explain any circumstances that might affect your driving, such as changes in employment, lifestyle, or family responsibilities. If your driving has become more infrequent, this should be noted.

- Highlight any safety precautions you’ve taken to mitigate risk, such as using a GPS or driving more cautiously.

Legal and Ethical Considerations

A letter of experience for auto insurance is a crucial document. Its accuracy and ethical presentation are paramount. Misrepresenting facts can have severe repercussions for both the applicant and the insurance provider. This section will Artikel the critical legal and ethical considerations involved in crafting a trustworthy letter.Providing a letter of experience requires unwavering honesty and transparency.

The information provided must be factual and meticulously accurate. Any deviation from the truth, no matter how minor, can compromise the integrity of the letter and potentially lead to serious legal consequences.

Honesty and Transparency

Accurate representation of past driving experiences is essential. Exaggerating positive aspects or concealing negative ones compromises the letter’s credibility. This includes admitting any violations, accidents, or traffic infractions. Complete disclosure, even if potentially unfavorable, is crucial to building trust and maintaining ethical standards.

Legal Implications of Inaccurate Information

Providing false or misleading information in a letter of experience has significant legal implications. Insurance companies rely on the accuracy of this information to assess risk and determine appropriate coverage. Fraudulent or intentionally misleading statements can result in legal action, including:

- Denial of insurance coverage.

- Cancellation of existing policies.

- Penalties and fines, including potential criminal charges.

- Significant financial repercussions for both the applicant and the insurance provider.

The legal ramifications of providing false information can be extensive and detrimental.

Protecting Personal Information

Protecting personal information is paramount when preparing a letter of experience. Maintain confidentiality and avoid sharing sensitive details beyond the scope of the letter’s purpose. Be mindful of the data you include and ensure its accuracy and relevance.

Best Practices for Maintaining Accurate Records

Maintaining accurate records for the letter of experience is crucial. This includes:

- Keeping detailed records of driving history, including dates, locations, and details of any accidents or violations.

- Storing copies of relevant documents, such as traffic tickets or accident reports.

- Regularly reviewing and updating records to ensure accuracy.

- Consulting with legal counsel or insurance professionals for guidance, if needed.

Thorough record-keeping safeguards against potential issues and enhances the overall credibility of the letter.

Closure

In conclusion, crafting a compelling auto insurance letter of experience is more than just documenting your driving history; it’s about showcasing your commitment to safe driving and responsible behavior. By understanding the structure, content, and legal implications, you can present your experience in a clear, concise, and accurate manner, increasing your chances of securing favorable insurance terms. This guide equips you with the knowledge and tools to navigate the process with confidence.

Top FAQs

What if I have a minor traffic violation?

Explain the violation concisely, emphasizing the circumstances and the steps you took to avoid future occurrences. Focus on responsible behavior and learning from the experience.

How do I present a previous claim positively?

Highlight the lessons learned and steps taken to prevent a recurrence. Focus on the positive actions taken since the incident.

What information should I include about my vehicle?

Include the make, model, year, and any relevant insurance history associated with the vehicle.

What are the legal implications of providing inaccurate information?

Honesty and transparency are paramount. Inaccurate information can lead to severe consequences, including policy denial or legal repercussions.