A life insurance contract that is under third party ownership presents unique legal and financial considerations. Understanding these intricacies is crucial for policyholders, third-party owners, and beneficiaries. This discussion will navigate the complexities of such arrangements, from defining ownership to managing potential disputes and tax implications. Gaining clarity on the rights and responsibilities of each party is paramount to ensuring a smooth and successful outcome.

This in-depth analysis will cover the essential elements of a life insurance policy held by a third party. We will delve into the nuances of policyholder rights, third-party responsibilities, and the potential impact on beneficiaries. A strong foundation in this knowledge will empower you to make informed decisions and safeguard your interests in such circumstances.

Defining Third-Party Ownership

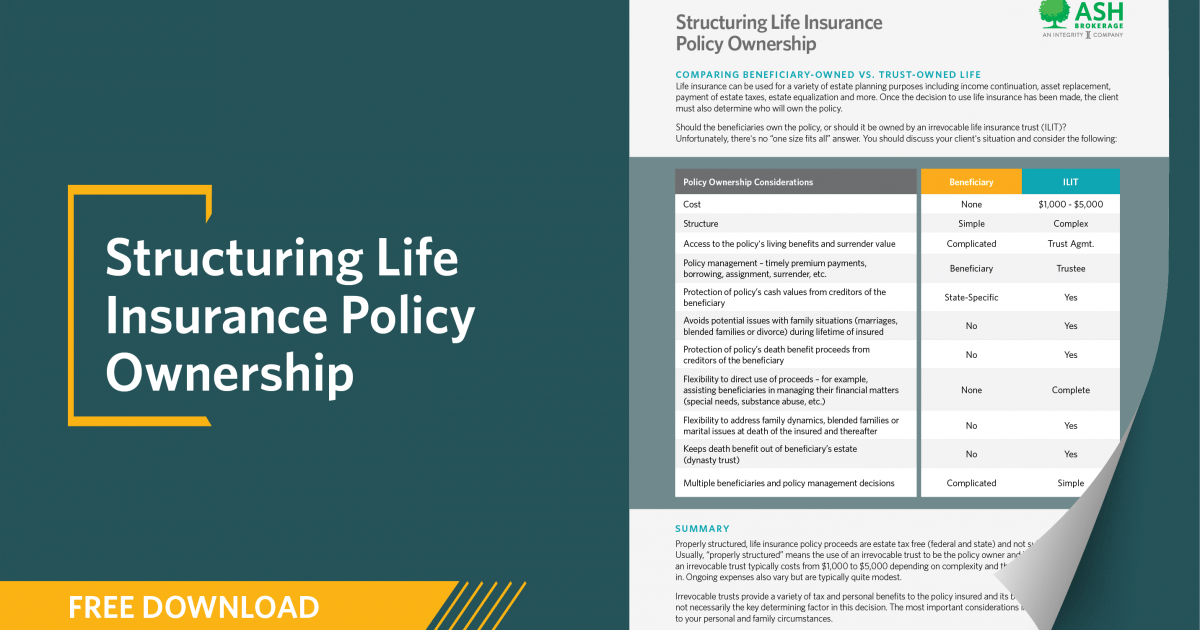

Third-party ownership of a life insurance policy signifies that the policy’s ownership and control are vested in an individual or entity other than the insured. This arrangement often serves specific financial or estate planning objectives. Understanding the intricacies of third-party ownership is crucial for both the policyholder and the third-party owner to ensure the policy’s proper administration and the realization of its intended benefits.This structure allows for flexibility in managing the policy’s benefits and ensures that the policy aligns with the needs of the third party.

Careful consideration of legal and financial implications is paramount to ensure the policy’s intended beneficiaries receive the benefits as intended.

Definition of Third-Party Ownership

Third-party ownership in life insurance occurs when an individual or entity other than the insured person holds legal title to the policy. This entity assumes the rights and responsibilities associated with the policy, including premium payments, policy changes, and claim procedures.

Legal and Financial Implications

Third-party ownership significantly alters the legal and financial landscape surrounding the life insurance policy. The third-party owner assumes the rights and responsibilities typically held by the insured, while the insured may retain some rights depending on the specific arrangement. This shift can have implications for tax liabilities, estate planning, and the ability to make changes to the policy.

For example, if the third-party owner is a trust, the trust’s terms and conditions dictate the policy’s management and distribution of benefits.

Methods of Third-Party Ownership

Several methods allow for the transfer of a life insurance policy to a third party. These include:

- Trusts: A trust, whether revocable or irrevocable, can be designated as the owner of a life insurance policy. This approach allows for the flexibility of managing the policy according to the trust’s terms and beneficiaries.

- Guardianships: A court-appointed guardian can be named as the policy owner, ensuring the policy’s management and benefits are handled in the best interest of the insured. This typically occurs for individuals who are legally incapacitated.

- Corporations: A corporation can assume ownership of a life insurance policy, often used for employee benefits or business purposes. This approach is frequently employed in corporate settings to ensure the policy’s management and benefits are aligned with the company’s objectives.

- Beneficiaries/Designated Owners: In some cases, the policy owner may choose to name a beneficiary or designated owner to handle the policy’s administration. This can be useful for estate planning or financial management.

Examples of Third-Party Ownership

Third-party ownership is frequently employed in various estate planning scenarios. For instance, a parent might place a life insurance policy under a trust to ensure funds are distributed according to specific instructions for their children. Similarly, a corporation might own a life insurance policy on a key employee to mitigate potential financial losses.

- Business Continuity: A corporation might own a policy on a key executive to ensure the company can weather potential financial losses if the executive passes away. The death benefit can be used to cover debts, salaries, or other obligations.

- Estate Planning: An individual may place a policy in a trust to control the distribution of funds after their death, avoiding probate or ensuring specific beneficiaries receive the funds.

Comparison of Rights and Responsibilities

The following table Artikels the rights and responsibilities of the policyholder, the third-party owner, and the beneficiary.

| Aspect | Policyholder | Third-Party Owner | Beneficiary |

|---|---|---|---|

| Rights | May have limited rights, depending on the specific agreement. | Has full control over the policy, including premium payments, policy changes, and claim procedures. | Enjoys the benefits Artikeld in the policy’s terms and conditions. |

| Responsibilities | May have limited responsibilities, depending on the specific agreement. | Responsible for premium payments, policy maintenance, and ensuring the policy remains in good standing. | Has no responsibilities unless a beneficiary is also the policy owner. |

Policyholder’s Rights and Obligations: A Life Insurance Contract That Is Under Third Party Ownership

A third-party ownership arrangement for a life insurance policy introduces specific rights and responsibilities for the policyholder. This structure necessitates a clear understanding of the limitations and implications, ensuring the policyholder’s interests are protected while respecting the rights of the third-party owner. The policyholder’s role is often defined by the terms of the agreement between the policyholder and the third-party owner, which should be carefully reviewed.Understanding these rights and obligations is crucial to navigating the policyholder’s relationship with the insurance company and the third-party owner.

This document Artikels the policyholder’s rights and obligations in detail, ensuring clarity and transparency throughout the policy’s duration.

Policyholder’s Rights

The policyholder, even when the policy is under third-party ownership, retains certain fundamental rights. These rights are generally Artikeld in the policy documents and the agreement with the third-party owner. Key rights include the right to receive policy-related communications, the right to request information regarding the policy status, and the right to participate in claim procedures, within the limitations set by the third-party owner.

Policyholder’s Obligations

The policyholder’s obligations are equally important. These obligations often involve adhering to the agreed-upon terms and conditions established between the policyholder and the third-party owner. This includes, but is not limited to, prompt notification of any changes to the policy, maintaining accurate records, and promptly addressing any inquiries from the insurance company or the third-party owner.

Implications of Limitations and Restrictions

Limitations imposed by the third-party owner on the policyholder’s rights should be clearly defined in the ownership agreement. These limitations could affect the policyholder’s ability to make changes to the policy, access information, or initiate claim procedures. The policyholder must carefully review these limitations to understand the scope of their rights and responsibilities.

Policy Changes, Access to Policy Information, and Claim Procedures

The policyholder’s rights concerning policy changes, access to policy information, and claim procedures are typically governed by the insurance policy contract, the agreement with the third-party owner, and applicable laws. These rights should be clearly Artikeld in the documents.

Policyholder’s Action Plan in Case of Policy Changes or Disputes

The following table Artikels the steps the policyholder should take in case of policy changes or disputes.

Understanding a life insurance contract held by a third party involves more than just the policy itself. It’s crucial to consider what supplementary coverage might be in place, like long-term care insurance. For instance, knowing what does John Hancock long-term care insurance cover can significantly impact the overall value and benefits associated with the third-party-owned life insurance contract.

This comprehensive understanding is vital when evaluating the complete financial picture of such a contract.

| Situation | Action Steps |

|---|---|

| Policy Changes |

|

| Disputes |

|

Third-Party Owner’s Rights and Responsibilities

The third-party owner, as a designated party managing a life insurance policy, holds significant responsibilities and rights. This section details these aspects, outlining the owner’s authority, obligations, and potential implications for the policyholder and beneficiary. Understanding these rights and responsibilities is crucial for both the third-party owner and the parties involved in the policy.The third-party owner’s role in managing a life insurance policy extends beyond simply holding the policy document.

It involves a crucial set of responsibilities and rights, ensuring the policy’s continued validity and benefits. This section clarifies these aspects to ensure a clear understanding of the associated obligations and privileges.

Third-Party Owner’s Rights

The third-party owner possesses the authority to exercise control over the policy’s administration. This includes the right to make decisions about premium payments, policy modifications, and the selection of beneficiaries. These rights are defined and Artikeld in the policy contract itself.

Third-Party Owner’s Responsibilities

The third-party owner has a duty to uphold the terms of the life insurance policy and to act in the best interest of the policy. This includes ensuring timely premium payments, and communicating any changes in circumstances to the insurer as required. Failure to fulfill these responsibilities could potentially affect the policy’s continuation or benefits.

Impact of Third-Party Owner’s Actions on Policyholder and Beneficiary

The actions of the third-party owner can directly influence the policyholder and beneficiary. For instance, if the third-party owner fails to make timely premium payments, the policy may lapse, resulting in the loss of coverage for the policyholder. Similarly, changes in beneficiary designations made by the third-party owner without the policyholder’s consent could lead to legal disputes.

Potential Liabilities of the Third-Party Owner

The third-party owner’s liability is typically limited to the terms and conditions of the insurance policy. However, if the owner acts fraudulently or with gross negligence, leading to financial losses for the policyholder or beneficiary, they could face legal repercussions.

Understanding a life insurance contract held by a third party can be complex. It’s crucial to remember that this type of contract often involves various stakeholders, including the policyholder, the third-party owner, and the insurance company. For a truly comprehensive understanding, exploring the diverse menu options at georgio’s restaurant & pizza menu might offer a parallel perspective on navigating complex ownership structures.

Ultimately, a clear understanding of the contract’s terms and conditions is paramount when dealing with a life insurance contract under third-party ownership.

Procedures for Exercising Rights and Responsibilities

The procedures for the third-party owner to exercise their rights and fulfill their responsibilities are clearly Artikeld in the insurance policy contract. These procedures may include providing written notification to the insurer about changes in the policy, or completing specific forms. Failure to adhere to these procedures could potentially hinder the owner’s ability to exercise their rights effectively.

Beneficiary’s Rights and Potential Impact

Beneficiaries in life insurance policies play a crucial role, as they are the designated recipients of the policy’s payout. However, when a third party owns the policy, the beneficiary’s rights and the potential impact of this ownership structure require careful consideration. This section Artikels the rights of the beneficiary under third-party ownership and addresses potential conflicts that may arise.Understanding the rights and responsibilities of all parties involved, especially the beneficiary, is essential for ensuring a smooth and equitable claim process.

This includes recognizing how the third-party owner’s actions can affect the beneficiary’s inheritance and being prepared for potential conflicts of interest.

Beneficiary’s Rights Under Third-Party Ownership

The beneficiary’s rights in a life insurance policy under third-party ownership are typically defined by the policy’s terms and conditions, as well as applicable state laws. These rights often include the right to receive the death benefit upon the insured’s demise, subject to the terms of the policy and any outstanding debts or obligations. However, the third-party ownership structure can significantly impact the beneficiary’s claim and inheritance.

Potential Impact of Third-Party Ownership on Beneficiary’s Rights

Third-party ownership can alter the beneficiary’s expected inheritance. For instance, if the third-party owner uses the policy for financial gain or to fulfill personal obligations, this could affect the amount the beneficiary receives. The beneficiary may have a reduced inheritance if the policy is used as collateral or if the policy’s cash value is depleted. This is especially true if the policy owner has financial difficulties or makes poor financial decisions.

Impact of Third-Party Owner’s Actions on Beneficiary’s Inheritance

The third-party owner’s actions directly influence the beneficiary’s potential inheritance. If the owner takes out loans against the policy or incurs debt, the policy’s value could diminish, potentially reducing the death benefit payable to the beneficiary. Furthermore, the third-party owner’s financial decisions or liabilities can significantly impact the amount the beneficiary ultimately receives. For example, if the third-party owner uses the policy’s funds to cover personal expenses, the death benefit could be reduced or eliminated.

Examples of Potential Conflicts of Interest

Conflicts of interest can arise between the third-party owner and the beneficiary. For instance, a parent who owns a life insurance policy on their child might decide to use the policy’s funds for their own needs, potentially diminishing the amount available to the child’s beneficiary. Another example involves a business owner who designates a trust as the policy’s owner.

The trustee might prioritize the trust’s interests over the beneficiary’s, leading to a potential conflict.

Table of Potential Conflicts and Solutions

| Potential Conflict | Possible Solution |

|---|---|

| Third-party owner depletes policy’s cash value through excessive withdrawals. | Review policy terms carefully, ensure beneficiary has knowledge of policy’s status. Consider seeking legal advice to establish clear expectations and protections for the beneficiary. |

| Third-party owner uses policy as collateral for loans. | Regular monitoring of the policy’s status by the beneficiary or a designated party. Review loan agreements carefully to understand the potential impact on the death benefit. |

| Third-party owner has substantial debt, potentially impacting the policy’s value. | Open communication between the third-party owner and the beneficiary. Seek professional advice on financial planning strategies that minimize risk to the policy and the beneficiary’s inheritance. |

| Third-party owner prioritizes personal needs over the beneficiary’s inheritance. | Establish clear communication protocols and expectations for policy use. Consider a trust or other legal mechanisms to safeguard the beneficiary’s interests. |

Tax Implications

Tax implications associated with third-party owned life insurance policies can be intricate and vary significantly based on the jurisdiction. Understanding these nuances is crucial for all parties involved – the policyholder, the third-party owner, and the beneficiary – to ensure compliance and avoid potential tax burdens. This section details the potential tax ramifications, highlighting jurisdictional differences and offering strategies to mitigate risks.

Potential Tax Implications for Policyholder

The policyholder, in a third-party owned life insurance policy, generally faces minimal direct tax implications related to premiums paid. However, there might be tax implications if the policy is considered part of a larger financial plan involving estate or gift taxes. For example, if the policyholder is gifting the policy to a third party, there might be gift tax implications depending on the value of the policy and the applicable gift tax rules in the jurisdiction.

Potential Tax Implications for Third-Party Owner

The third-party owner, often a trustee or a designated individual, might encounter tax implications depending on the nature of their ownership. If the third-party owner receives policy benefits, such as dividends or death benefits, they might need to pay taxes on those amounts according to the applicable tax laws of their jurisdiction. For example, if a corporation owns the policy, the income from the policy will be taxed at the corporate level, and any subsequent distributions to shareholders might also be subject to individual income tax.

Potential Tax Implications for Beneficiary

The beneficiary’s tax implications vary greatly based on the policy terms, the jurisdiction, and the nature of the death benefit. Generally, the death benefit received by the beneficiary is tax-free in many jurisdictions. However, there may be tax implications if the death benefit is considered part of a larger estate or if the beneficiary is part of a complex estate plan.

For instance, if the death benefit is substantially high, it might trigger estate tax implications, especially if the beneficiary is a non-resident or if the beneficiary’s tax jurisdiction differs from the policy’s.

Jurisdictional Variations in Tax Implications

Tax laws regarding life insurance policies vary significantly from one jurisdiction to another. The tax implications depend on specific regulations in each country, state, or province. For example, some jurisdictions may have different rules regarding the taxation of death benefits compared to others. This variation requires careful consideration and adherence to the specific regulations of the relevant jurisdiction.

Mitigation Strategies for Tax Risks

To mitigate tax risks, consulting with a qualified tax professional is crucial. A professional can help evaluate the specific tax implications based on the policy terms, the ownership structure, and the jurisdiction involved. Additionally, structuring the policy in compliance with applicable tax laws can significantly reduce potential tax liabilities. For example, working with a tax advisor can help identify strategies for optimizing the tax implications of the policy and ensure compliance.

Comparative Analysis of Tax Implications Across Different Jurisdictions

| Jurisdiction | Taxation of Premiums (Policyholder) | Taxation of Policy Benefits (Third-Party Owner) | Taxation of Death Benefits (Beneficiary) |

|---|---|---|---|

| United States | Generally, no direct tax on premiums. | Income from policy subject to individual or corporate income tax depending on owner. | Death benefits generally tax-free to beneficiaries, subject to estate tax if part of large estate. |

| United Kingdom | Premiums generally not directly taxed. | Income from policy subject to income tax depending on owner. | Death benefits generally tax-free to beneficiaries, subject to inheritance tax if part of large estate. |

| Canada | Premiums generally not directly taxed. | Income from policy subject to income tax depending on owner. | Death benefits generally tax-free to beneficiaries, subject to estate tax if part of large estate. |

Note: This table provides a general overview. Specific tax implications may vary depending on individual circumstances and the particular policy terms. Always consult with a qualified tax advisor for personalized advice.

Policy Change and Disputes

Navigating policy changes and potential disputes in a life insurance policy held under third-party ownership requires careful consideration of the roles and responsibilities of all parties involved. Understanding the procedures for modifications and conflict resolution is crucial to safeguarding the interests of the policyholder, the third-party owner, and the beneficiary.The process for amending a life insurance policy held by a third party is multifaceted, demanding adherence to the stipulations Artikeld in the policy document and applicable laws.

This section details the necessary steps and potential pitfalls to ensure a smooth and equitable process.

Policy Change Procedures

Policy modifications, such as changes in coverage amounts, beneficiaries, or premium payment schedules, require a coordinated effort between the policyholder, third-party owner, and the insurance provider. Specific procedures are Artikeld in the policy agreement and must be followed meticulously. The policy document should clearly delineate the required documentation, including written authorization from all parties involved.

Dispute Resolution Process

Disagreements may arise concerning policy interpretation, premium payments, or beneficiary designations. An established dispute resolution process is vital to address these conflicts effectively and efficiently. This often involves a formal complaint process, mediation, and potentially, litigation.

Common Disputes and Potential Resolutions

- Disputes over Premium Payments: Discrepancies in premium payment responsibilities between the policyholder and the third-party owner can lead to disputes. These can be resolved through clarification of the agreed-upon payment schedule and method as documented in the ownership agreement, or through direct negotiation between the parties.

- Disagreements on Beneficiary Designations: Changes to beneficiary designations may necessitate the agreement of all involved parties. Failure to adhere to the policy’s stipulated procedures or obtain the necessary approvals from all parties can lead to disputes. These can be resolved through mediation or, if necessary, through legal action to ensure compliance with the terms of the agreement and applicable laws.

- Third-Party Owner Disputes with Policyholder: Disagreements regarding the policy’s management and ownership rights between the policyholder and third-party owner require careful consideration. A written agreement or contract, explicitly outlining the responsibilities of each party, can help mitigate potential disputes. Negotiation or mediation can often resolve these issues.

Legal Recourse

The availability of legal recourse depends on the specific jurisdiction and the terms of the insurance policy. Policyholders, third-party owners, and beneficiaries may pursue legal action if attempts at negotiation or mediation fail. This might involve filing a lawsuit to enforce the policy terms, seek injunctions, or demand financial compensation.

Dispute Resolution Flowchart

| Step | Action |

|---|---|

| 1 | Identify the dispute and document the facts. |

| 2 | Attempt informal resolution (negotiation, communication). |

| 3 | If informal resolution fails, initiate mediation. |

| 4 | If mediation fails, consult legal counsel and consider arbitration or litigation. |

| 5 | Follow the court’s decision or settlement agreement. |

Insurance Company’s Role

The insurance company plays a crucial role in managing policies where ownership is transferred to a third party. This involves careful adherence to the terms of the policy and the contractual obligations Artikeld in the agreement. This section details the insurance company’s responsibilities, limitations, and communication protocols within this specific context.The insurance company acts as a custodian of the policy, ensuring its integrity and proper administration while the third-party owner takes on the management responsibilities.

This necessitates a clear understanding of the roles and responsibilities of all parties involved, especially regarding communication and reporting.

Insurance Company’s Obligations

The insurance company is obligated to maintain the policy’s records accurately and promptly respond to requests from the third-party owner. This includes providing necessary documentation and information related to the policy, including details about the policyholder, coverage limits, and payment history. Their obligation also encompasses promptly processing claims and communicating any changes to the policy or its terms to the third-party owner.

Insurance Company’s Limitations

The insurance company’s responsibilities are limited to the contractual terms of the policy and the applicable laws. The company is not responsible for the actions or decisions made by the third-party owner. For instance, the insurance company is not liable for the third-party owner’s failure to fulfill their obligations, such as making timely premium payments.

Communication and Reporting Requirements, A life insurance contract that is under third party ownership

Effective communication is paramount in maintaining a smooth and transparent relationship between the insurance company and the third-party owner. The insurance company must establish clear communication channels and procedures, outlining how and when the third-party owner can expect to receive updates or information about the policy. These channels must be clearly defined in the policy contract.

Examples of Interactions

The insurance company might interact with the third-party owner in several ways. For instance, the company might send regular policy statements to the third-party owner, highlighting any upcoming premium due dates or important policy updates. In the event of a claim, the insurance company would inform the third-party owner of the claim status and any necessary actions. A change of beneficiary would also necessitate communication to ensure the third-party owner is aware of any amendments.

Procedures for Insurance Company

| Situation | Insurance Company Procedure |

|---|---|

| Policy premium payment is overdue | Send a notification to the third-party owner, outlining the overdue amount and the consequences of non-payment. This could involve informing the third-party owner of potential policy lapse. |

| Third-party owner requests policy document | Provide the requested documents within the stipulated timeframe, adhering to the policy’s access protocol. |

| Claim is submitted | Evaluate the claim in accordance with the policy terms and applicable laws. Notify the third-party owner of the claim status, the process, and any required documentation. |

| Policyholder information changes | Update the policy records with the new information provided by the third-party owner, ensuring accuracy and compliance. Notify the third-party owner of any changes and potential impacts. |

Final Thoughts

In conclusion, a life insurance contract under third-party ownership requires careful consideration of various factors, from legal implications to tax considerations. Understanding the rights and responsibilities of each party is paramount to mitigating potential conflicts and ensuring a positive outcome for all stakeholders. By diligently navigating these complexities, you can confidently manage these arrangements, maximizing benefits and minimizing potential risks.

Quick FAQs

What are the common reasons for a life insurance policy to be placed under third-party ownership?

Third-party ownership is often employed in situations like trusts, guardianships, or corporate structures. These arrangements may be designed to manage assets, protect beneficiaries, or fulfill specific financial objectives.

What are the potential tax implications for the third-party owner?

Tax implications vary significantly depending on jurisdiction and the specific structure of the third-party ownership. Consult with a tax professional to understand the implications in your specific situation.

What are the procedures for resolving disputes between the policyholder, third-party owner, and beneficiary?

Disputes may be resolved through negotiation, mediation, or, if necessary, legal action. Understanding the available legal recourse is crucial for navigating these situations effectively.

How does the insurance company’s role differ when a policy is under third-party ownership?

The insurance company’s interaction with the third-party owner will differ, and clear communication is vital. The insurance company will need to confirm the third-party owner’s authority to make decisions regarding the policy.