An insured is covered with a health insurance policy, a vital aspect of modern life. Navigating the complexities of health insurance can feel daunting, but understanding your coverage is crucial for peace of mind. This comprehensive guide delves into the intricacies of insurance policies, outlining what constitutes coverage, policy terms, and the claims process, empowering you to confidently make informed decisions about your healthcare needs.

This exploration of health insurance coverage will shed light on the various types of plans, their specific benefits and exclusions, and the steps involved in navigating the claims process. We’ll examine how coverage varies across different plans, regions, and healthcare providers, ensuring you gain a comprehensive understanding of your rights and responsibilities.

Defining Coverage Scope

The labyrinthine world of health insurance often leaves individuals adrift, grappling with the intricacies of coverage. Understanding precisely what your policy covers is paramount, a critical first step in navigating the healthcare landscape with confidence. This section meticulously dissects the concept of “covered” services, revealing the nuanced distinctions between various plans and the limitations that might impact your care.Comprehensive health insurance policies are not monolithic entities; rather, they are diverse constructs, each tailored to specific needs and budgets.

The spectrum of coverage extends from basic plans, designed for the cost-conscious, to comprehensive plans, designed to provide extensive care. This analysis reveals the subtle yet significant variations in what is and isn’t included in each plan, enabling you to make informed decisions about your healthcare needs.

Covered Services Under Health Insurance Policies

Health insurance policies typically cover a wide range of medical services, including preventative care, emergency treatment, and hospitalizations. The specifics vary considerably from plan to plan, encompassing everything from routine checkups to complex surgical interventions. Coverage frequently extends to prescription medications, mental health services, and rehabilitative therapies.

Different Types of Health Insurance Plans

The landscape of health insurance is characterized by a variety of plans, each with its own distinct features and coverage levels. A few examples include:

- Preferred Provider Organizations (PPOs): These plans offer greater flexibility in choosing healthcare providers, often at a higher premium. Patients typically pay a copay or coinsurance for services received from in-network providers. A higher out-of-pocket cost might be expected if you utilize providers outside the network.

- Health Maintenance Organizations (HMOs): HMOs typically require patients to select a primary care physician (PCP) who manages referrals to specialists. This approach often leads to lower premiums, but patients have a more limited selection of healthcare providers within the network.

- Exclusive Provider Organizations (EPOs): EPOs combine elements of both PPOs and HMOs, offering greater flexibility than HMOs but with fewer out-of-network benefits than PPOs.

- Catastrophic Plans: Designed for high-risk situations, these plans typically provide coverage for severe illnesses or accidents, often with a large deductible.

Exclusions and Limitations

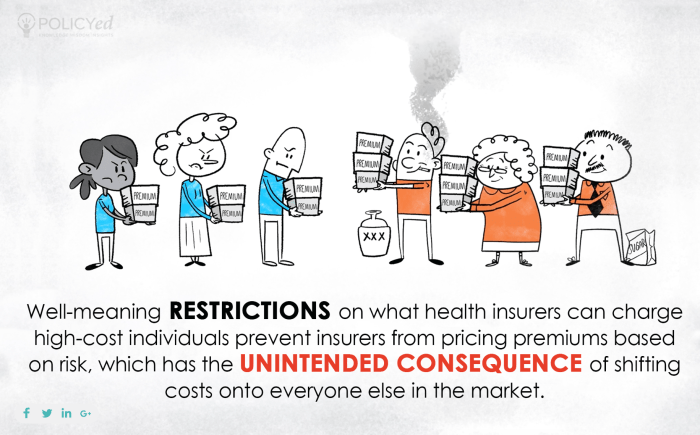

Crucially, every health insurance policy includes exclusions and limitations. These represent specific services or conditions that are not covered, such as pre-existing conditions (though some plans offer coverage for these with additional costs), experimental treatments, and cosmetic procedures. It’s vital to carefully review the policy documents to understand these exclusions. Furthermore, coverage levels often depend on factors like the patient’s age, location, and health status.

Comparison of Health Insurance Plans

| Plan Type | Covered Services | Exclusions |

|---|---|---|

| PPO | Wide range of in-network and out-of-network providers; routine checkups, specialist visits, hospitalizations, prescription drugs. | Out-of-network care may have significant cost-sharing; certain pre-existing conditions or treatments might be excluded. |

| HMO | Comprehensive in-network care; routine checkups, specialist visits (with referral), hospitalizations, prescription drugs. | Limited provider network; out-of-network care typically not covered. |

| EPO | In-network care with greater flexibility than HMOs; routine checkups, specialist visits. | Limited out-of-network benefits; may not cover all services even within the network. |

| Catastrophic | Severe illnesses or accidents; hospitalizations, intensive care. | Limited coverage for routine care; high deductibles before benefits kick in. |

Understanding Policy Terms

Navigating the labyrinthine world of health insurance policies can feel like deciphering an ancient script. Yet, a profound understanding of these terms is paramount to securing the care you deserve. Misinterpretation can lead to costly exclusions and frustrating delays in accessing essential services. Comprehending the fine print empowers you to make informed decisions, ensuring your policy truly serves as a safeguard.

The Crucial Role of Policy Terms

Policy terms are not mere legal jargon; they are the very architecture of your coverage. They delineate the boundaries of your protection, defining exactly what services are included and excluded. Failure to grasp these terms can lead to unforeseen financial burdens and a diminished ability to receive the medical attention you require. This knowledge is the bedrock of responsible healthcare management.

Common Policy Terms and Their Meanings

A comprehensive grasp of common policy terms is essential to understanding your benefits. These terms, often shrouded in technical language, hold the key to unlocking your access to care.

| Term | Definition | Example |

|---|---|---|

| Deductible | The amount you pay out-of-pocket for covered services before your insurance begins to pay. | You have a $1,500 deductible. Before your insurance kicks in, you’re responsible for the first $1,500 of eligible expenses. |

| Copay | A fixed amount you pay for a covered service, such as a doctor’s visit or prescription. | A copay of $25 is required for each office visit. |

| Coinsurance | The percentage of covered expenses you are responsible for after meeting your deductible. | You have a 20% coinsurance. After your deductible is met, you pay 20% of the cost of covered services. |

| Out-of-Pocket Maximum | The maximum amount you will pay out-of-pocket for covered services in a given plan year. | Your out-of-pocket maximum is $6,000. Once you reach this limit, your insurance will cover 100% of eligible expenses. |

| Pre-authorization | A required step for certain procedures, where your insurance company must approve the service in advance. | Certain surgeries require pre-authorization from the insurance company. |

| Network Provider | A healthcare provider who contracts with your insurance company. | Dr. Smith is a network provider for your plan, so your costs will be lower. |

| Excluded Services | Services that are not covered by your insurance plan. | Cosmetic procedures are typically excluded services under most health insurance plans. |

Impact on Access to Care

Understanding these policy terms directly impacts your access to care. A thorough knowledge of deductibles, copays, and coinsurance allows you to budget effectively and anticipate potential financial responsibilities. Knowing which services are excluded can help you avoid unnecessary expenses and potentially redirect care towards in-network providers, thus minimizing out-of-pocket costs. A clear understanding of your policy ensures you are not blindsided by unexpected bills or denied care.

It empowers you to make informed decisions regarding your health and well-being.

Illustrating Covered Services

Unraveling the intricate tapestry of your health insurance coverage reveals a world of possibilities. This crucial aspect of your policy ensures that you’re not alone in the face of unforeseen medical exigencies. Comprehending the specific services covered is paramount to maximizing the benefits your policy offers.The labyrinthine world of medical procedures and treatments can be daunting. However, understanding the specific services your policy encompasses empowers you to make informed decisions and navigate the healthcare system with confidence.

Common Medical Services Covered

Your policy likely covers a spectrum of essential medical services, from routine check-ups to complex treatments. This section provides a detailed overview of common covered services.

- Preventive Care: Routine check-ups, immunizations, and screenings are often a cornerstone of preventative care, protecting your well-being and identifying potential health issues early. These essential services are designed to detect and address potential problems before they escalate.

- Emergency Room Visits: Should a medical emergency arise, your policy will likely cover essential emergency room care, providing immediate access to crucial medical interventions. This includes treatment for injuries and acute illnesses.

- Hospitalization: In cases of prolonged illness or injury requiring hospitalization, your policy often covers essential aspects of your stay, from room and board to necessary medical procedures.

- Surgical Procedures: Certain surgical procedures, including those for routine or complex conditions, may be covered. However, coverage varies significantly depending on the specific nature and complexity of the procedure. Specific procedures are detailed in the policy document.

- Prescription Medications: Your policy may cover a portion or all of the costs associated with prescription medications, crucial for managing chronic conditions and maintaining overall health. Note that there may be limitations and exclusions on certain medications.

Examples of Covered Procedures and Consultations

A deeper dive into the specific medical procedures covered under your policy is vital. Below are a few examples.

- Physical Therapy: Rehabilitation following an injury or surgery may necessitate physical therapy. This crucial aspect of recovery is often covered by policies.

- Diagnostic Imaging: Procedures such as X-rays, CT scans, and MRIs are often covered for diagnostic purposes, helping doctors pinpoint the source of medical concerns.

- Specialized Consultations: Consultations with specialists, such as cardiologists or dermatologists, may be covered, depending on the specific circumstances and the nature of the consultation.

- Outpatient Services: Many policies cover outpatient services, including procedures performed outside of a hospital setting. These may include certain surgical procedures and diagnostic tests.

Coverage for Specific Health Conditions

The application of coverage varies depending on the health condition. Consider how a particular condition might be addressed under different plans.

| Health Condition | Covered Services (Example) | Potential Exclusions (Example) |

|---|---|---|

| Diabetes | Routine check-ups, prescription medications, blood glucose monitoring supplies, some specialized consultations | Advanced treatments for complications like kidney failure, if not directly related to the initial diabetes diagnosis. |

| Heart Disease | Cardiac rehabilitation, cardiac consultations, certain medications, diagnostic testing (e.g., ECG, stress test). | Procedures specifically related to advanced heart conditions, such as a coronary artery bypass graft (CABG) if deemed experimental or not medically necessary. |

| Mental Health Conditions | Psychiatric evaluations, therapy sessions, medication coverage (depending on the plan). | Certain experimental therapies or very high-cost treatments for mental health conditions may be excluded. |

Preventative Care Services

Recognizing the significance of preventative care, your policy likely includes a range of services aimed at maintaining optimal health. These are critical for early detection and intervention.

- Annual Check-ups: Routine check-ups with your primary care physician.

- Vaccinations: Immunizations against various diseases.

- Cancer Screenings: Screenings for various types of cancer, such as mammograms or colonoscopies.

- Blood Pressure Monitoring: Regular monitoring of blood pressure.

Examining Claims Process

Unraveling the intricate tapestry of healthcare claims can feel like navigating a labyrinth. Yet, understanding the process empowers you to secure the coverage you deserve. This section illuminates the path to claim submission, ensuring a smooth and efficient experience.Navigating the healthcare claims process is crucial for securing your rightful benefits. The meticulous steps Artikeld here provide a clear roadmap, empowering you to confidently file claims and receive timely reimbursements.

A thorough understanding of these procedures is essential to avoid potential delays or denials.

Claim Filing Procedure

The journey to receiving coverage begins with meticulous preparation. This involves assembling the necessary documentation, meticulously completing the claim form, and strategically submitting the claim to the insurer. A well-organized approach minimizes delays and maximizes your chances of a swift and favorable resolution.

Required Documentation

A comprehensive claim necessitates precise and accurate documentation. The specific requirements vary depending on the type of claim and the insurance policy, but some common documents include medical records, receipts, and supporting documentation for services rendered. Failure to furnish complete and accurate documentation may lead to claim denial.

- Medical Records: Original or certified copies of medical records, including diagnoses, treatment plans, and dates of service, are critical for validating the claim. These records serve as irrefutable evidence of the need for medical care.

- Receipts and Bills: Copies of all receipts and bills associated with the services rendered are essential. These documents substantiate the incurred expenses and form the basis for reimbursement.

- Supporting Documentation: Depending on the specific claim, additional documents may be required, such as pre-authorization forms, physician’s letters, or supporting medical evidence. The necessity of such documents varies based on the specific policy and the nature of the medical condition or treatment.

Completing the Claim Form

The claim form acts as the formal request for coverage. Accurate and complete information is paramount. Carefully review the form, ensuring all fields are filled correctly, and verify the accuracy of the details provided. Errors on the form may lead to delays or denial of the claim.

- Accuracy is Key: All information must be meticulously accurate. Errors or inconsistencies can significantly delay the claim’s processing. Double-checking entries and confirming details with the supporting documents is critical.

- Thoroughness is Paramount: Ensure all necessary sections of the form are completely filled. Missing information can result in the claim being incomplete and potentially rejected. Leave no blank spaces.

- Clear and Concise Language: Use clear and concise language when providing information. Ambiguity or vagueness can lead to misunderstandings and complicate the claims process.

Methods of Filing Claims

Insurers offer various claim filing methods, catering to diverse preferences and needs. These options range from traditional paper submissions to streamlined online portals.

- Paper Claims: Some insurers still accept paper claims. However, the process can be slower and more prone to errors. These submissions often require a physical mail-in process.

- Online Claims: Many insurers provide online claim portals for seamless submission. These portals allow for secure electronic submission of documents, often offering real-time tracking of the claim status.

- Phone Claims: For certain claims or situations, insurers may offer a phone-based system for filing. This option can be helpful for individuals needing assistance or clarification. These calls are often routed to a dedicated claims department for handling.

Examples of Claims Scenarios and Coverage

Consider a patient requiring surgery. The claim would include the surgical procedure cost, pre- and post-operative care, and any related medications. The specific coverage will depend on the policy’s terms and the procedures performed.

| Scenario | Coverage Application |

|---|---|

| Emergency Room Visit | Coverage for necessary services, including diagnostic tests, medications, and physician fees, would be assessed against the policy’s terms. |

| Hospitalization | Coverage for room and board, medical services, and medications during hospitalization. Policy details will determine the extent of coverage. |

| Prescription Medications | Coverage for prescribed medications, subject to formulary restrictions and cost-sharing provisions Artikeld in the policy. |

Illustrative Case Studies

The tapestry of healthcare coverage, woven with intricate threads of policy stipulations, can be bewildering. Yet, understanding these threads is crucial for navigating the complexities of healthcare expenses. This section unveils case studies, illuminating the nuances of coverage and the critical factors that determine its application. We delve into scenarios where claims are honored and where limitations arise, offering a stark yet informative perspective.These case studies, meticulously crafted, provide tangible examples of how your policy functions in real-world situations.

They dissect the intricacies of coverage, illustrating how varying circumstances impact claim approvals and denials. By examining these instances, you gain a profound understanding of your rights and responsibilities under your specific health insurance policy.

Covered Medical Expenses in Routine Care, An insured is covered with a health insurance policy

Routine checkups, preventative screenings, and vaccinations are pivotal in maintaining well-being. A policyholder, Ms. Emily Carter, scheduled a routine annual physical examination, including blood tests. Her policy clearly Artikeld coverage for preventive care, including these procedures. The claim was processed swiftly and without issue, demonstrating the policy’s comprehensive approach to routine healthcare.

This illustrates the policy’s commitment to proactive health management. A separate case, Mr. David Lee, who underwent a well-woman checkup and a mammogram, saw his claim approved in full accordance with the policy’s stipulations. These examples show how insurance policies support routine health maintenance.

Handling Major Illnesses and Procedures

Imagine a situation where a policyholder, Mr. Robert Johnson, experiences a severe heart attack requiring a complex angioplasty procedure. Policies typically cover the cost of the angioplasty, hospitalization, and necessary medications, as long as the procedures align with the policy’s stipulations and pre-authorization requirements. A comprehensive review of the policy’s provisions regarding pre-authorization processes and specific medical procedures is essential to determine coverage.

Furthermore, specific clauses regarding coverage for chronic conditions like diabetes must be understood. Mr. Johnson’s claim was fully approved, reflecting the policy’s extensive coverage for major illnesses. The policyholder’s prompt compliance with all necessary pre-authorization procedures was key to the successful processing of the claim.

Uncovered Expenses and Claim Denials

A critical aspect of understanding coverage involves identifying situations where claims are not covered. For instance, Ms. Sarah Chen sought coverage for a cosmetic surgery procedure. Her policy explicitly excluded coverage for cosmetic enhancements, aligning with standard industry practices. This exemplifies the importance of meticulously reviewing the policy’s exclusions.

Another scenario: Mr. John Smith sought coverage for a treatment not recognized by the policy’s network of providers. The policy clearly Artikels that only treatments rendered by contracted providers are covered, and therefore, his claim was denied. These situations highlight the crucial need for careful scrutiny of policy provisions, particularly exclusionary clauses.

Comparative Analysis of Different Policies

Different policies exhibit varying approaches to handling similar claims. Consider a hypothetical case involving a hospitalization claim. Policy A might cover a broader range of hospital services, including advanced intensive care unit (ICU) stays, whereas Policy B might have stricter stipulations regarding ICU coverage. Policy A might also provide higher daily room and board allowances. Such differences are crucial for informed decision-making.

Policies also differ in their reimbursement rates for specific medical procedures. Understanding these differences is essential for evaluating which policy best suits individual needs. A table illustrating the different provisions of various policies is presented below:

| Policy | ICU Coverage | Daily Room and Board Allowance | Reimbursement Rate (Angioplasty) |

|---|---|---|---|

| Policy A | Comprehensive | High | 95% |

| Policy B | Limited | Moderate | 80% |

| Policy C | Partial | Low | 70% |

Coverage Variations: An Insured Is Covered With A Health Insurance Policy

The labyrinthine world of health insurance unveils a tapestry of complexities, where coverage isn’t a monolithic entity but rather a mosaic of variations. These disparities, often subtle yet impactful, can dramatically alter the scope of protection afforded to individuals and families. Navigating these nuances is crucial for informed decision-making, ensuring a robust safety net in the face of unforeseen health challenges.

Regional Discrepancies in Coverage

State-level regulations and market dynamics often dictate the breadth and depth of health insurance benefits. These variations in coverage frequently manifest in differing levels of financial responsibility for various medical procedures, influencing the practical accessibility of care. Understanding these variations is paramount for those seeking insurance policies that align with their unique needs and circumstances.

| Region | Common Coverage Differences |

|---|---|

| Northeast | Higher premiums, often with comprehensive coverage for specialized procedures, but potentially higher deductibles for preventative care. |

| Midwest | Premiums moderate, with a balance between comprehensive and preventive care coverage, often with negotiated rates for common procedures with participating providers. |

| South | Premiums generally lower, but coverage for some specialized procedures might be limited, and there might be a higher prevalence of cost-sharing mechanisms. |

| West | Premiums can fluctuate widely based on specific regions, with some areas offering generous coverage for alternative therapies, while others focus heavily on preventative care. |

Provider-Specific Benefit Differences

Insurance providers, while operating within regulatory frameworks, maintain autonomy in crafting their benefit packages. Consequently, identical procedures may be treated differently across providers, impacting the out-of-pocket expenses for the insured. This divergence underscores the importance of a thorough evaluation of specific policy provisions before committing to a particular plan.

While a health insurance policy safeguards an insured’s well-being, consideration should also be given to financial security. A crucial aspect of this is accessing a security mutual life insurance loan, which can provide much-needed capital for unforeseen circumstances. These loans, tailored to meet specific needs, can supplement the protection offered by a health insurance policy, ensuring comprehensive financial security for the insured.

This careful planning can ensure continued well-being in a variety of situations. security mutual life insurance loan options provide additional layers of financial safety, ultimately bolstering the overall protection of the insured.

Impact of Age and Pre-existing Conditions

Age and pre-existing conditions are significant factors that influence coverage. Policies frequently adjust premiums based on age, reflecting the expected healthcare costs associated with different life stages. Pre-existing conditions can also impact coverage, with some plans imposing limitations or exclusions, and others offering more comprehensive protection, even with pre-existing conditions.

“The healthcare marketplace is a complex ecosystem, and these disparities highlight the need for vigilant comparison and understanding.”

Illustrative Examples of Coverage

Unraveling the intricate tapestry of healthcare coverage, this section delves into the specifics of how your policy safeguards you against the uncertainties of illness and injury. Understanding the granular details of your coverage is paramount, empowering informed decisions and alleviating anxieties during challenging times.

Routine Checkups and Preventative Care

Preventive care is not just a recommendation; it’s a cornerstone of proactive health management. Policies often cover routine checkups, vaccinations, and screenings for early detection of potential health issues. These services, while seemingly minor, are crucial for maintaining overall well-being and preventing more significant, costly problems down the line. For instance, an annual physical exam, including blood work and vital sign monitoring, might be fully covered under your policy, while vaccinations for common illnesses may be partially or fully reimbursed.

These preventative measures can translate to substantial long-term savings, as early intervention can significantly reduce the severity and duration of illnesses.

Surgical Procedures and Hospital Stays

Surgical procedures, often requiring extensive hospital stays, can incur substantial costs. Comprehensive health insurance policies meticulously detail the scope of coverage for various surgical procedures, specifying the portion covered. For example, a simple outpatient procedure like a cataract removal may have a predetermined out-of-pocket maximum, while a complex laparoscopic surgery, demanding an extended hospital stay, might have a more intricate reimbursement structure, potentially involving deductibles, co-pays, and coinsurance percentages.

An insured’s peace of mind, secured by a comprehensive health insurance policy, often mirrors the careful consideration of vehicle features. Just as one meticulously researches the difference between Honda CR-V trims like EX, EX-L, and Touring, comparing these models highlights the varying levels of coverage and benefits, ultimately impacting the financial security of the insured party. This crucial understanding of policy details and benefits ensures that the insured is well-prepared for unexpected healthcare needs.

The specifics are meticulously Artikeld in your policy document. Furthermore, the policy clearly defines covered expenses during a hospital stay, including room and board, medical supplies, and services provided by the hospital staff.

Prescription Drug Coverage

Prescription drug coverage is a critical component of comprehensive healthcare plans. Policies often Artikel a tiered approach to prescription drug reimbursements, categorizing drugs based on their cost and clinical necessity. For example, a generic medication might be fully covered, while a brand-name medication might require a co-pay or coinsurance. This tiered structure ensures that essential medications remain accessible while also promoting cost-effectiveness.

Policies also define formulary lists, specifying the drugs covered, often based on factors like efficacy and cost-effectiveness.

Mental Health and Addiction Treatment

Mental health and addiction treatment are now recognized as crucial components of overall well-being. Modern health insurance policies increasingly include coverage for mental health services and addiction treatment. This often involves specific requirements, such as the need for a referral from a primary care physician or a pre-authorization for certain therapies. The level of coverage for these services varies, and it is crucial to consult your policy document to understand the specifics.

The treatment process, whether therapy or medication management, is generally covered based on the chosen provider’s in-network status.

Dental and Vision Care

Dental and vision care coverage often falls under a separate section of your health insurance policy. Policies may offer varying levels of coverage, ranging from basic preventative care to comprehensive procedures. For example, preventative care, such as routine cleanings and checkups, might be fully covered, while restorative procedures like fillings or crowns might have a co-pay or coinsurance component.

Vision care coverage can include routine eye exams, glasses, or contact lenses. Specific details on dental and vision coverage are crucial and should be examined thoroughly.

Illustrative Case Study: Hospital Stay

Consider a hypothetical scenario where an individual experiences a sudden illness requiring a lengthy hospital stay. The policy would typically cover a portion of the hospital’s charges, including room and board, medical supplies, and the services of healthcare professionals. The specific expenses covered, and the proportion covered, are detailed in the policy document. This includes expenses related to diagnostic tests, medications administered in the hospital, and any necessary procedures performed during the stay.

Out-of-pocket expenses are calculated based on the policy’s terms, which specify deductibles, co-pays, and coinsurance percentages.

Summary

In conclusion, understanding health insurance coverage is a fundamental step toward responsible healthcare management. This guide has provided a framework for comprehending your policy, from defining covered services to the claims process. By knowing your rights and responsibilities, you can confidently approach healthcare needs, knowing you’re protected by a comprehensive policy. Remember to consult with your insurance provider for specific details regarding your plan.

Top FAQs

What happens if a medical procedure isn’t explicitly listed as covered?

If a specific medical procedure isn’t explicitly listed as covered, it may fall under an exclusion or be subject to a higher out-of-pocket cost. Review the policy’s exclusions and limitations carefully, or consult with your insurance provider for clarification.

How do pre-existing conditions affect coverage?

Pre-existing conditions can be handled differently depending on the plan. Some policies may have waiting periods before coverage applies, while others may cover these conditions without restrictions. Your policy document should Artikel the specific details of how pre-existing conditions are handled.

What documentation is typically needed for filing a claim?

Required documentation often includes the claim form, medical records, receipts, and any other supporting documents specified by your insurance provider. Review your policy’s guidelines for a detailed list of necessary documents.

What are some common reasons a claim might be denied?

Claims may be denied if the procedure or service isn’t covered, if the necessary documentation isn’t provided, or if the claim doesn’t meet the policy’s requirements. Review your policy’s terms for specific reasons for claim denial.