Practice life insurance exam free is your ultimate guide to nailing that insurance exam! Get ready to slay those questions with tons of free resources, smart strategies, and a deep dive into crucial concepts. We’ll break down everything from the different exam types to the common pitfalls, so you can ace your exam with confidence. Level up your insurance knowledge now!

This comprehensive resource provides a wealth of information on preparing for life insurance exams. We cover everything from various free practice resources and exam strategies to key concepts, common mistakes, and helpful study tips. Get ready to pass with flying colors!

Exam Preparation Resources

Successfully navigating a life insurance exam requires strategic preparation. This section details valuable resources available to candidates, encompassing practice questions, study guides, and video tutorials, categorized by exam provider or subject matter. This comprehensive approach will help candidates gain a deeper understanding of the core concepts and improve their performance on the exam.

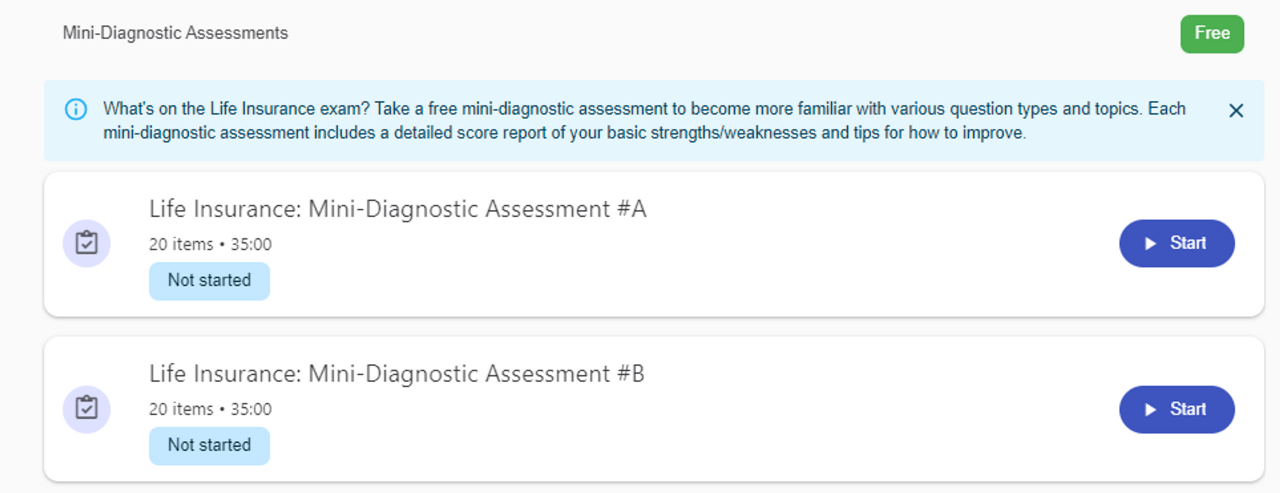

Free Practice Exam Resources

Numerous free online resources offer practice materials for life insurance exams. These resources are crucial for reinforcing knowledge and building confidence in answering exam questions.

- Practice Questions: Many websites dedicated to insurance education provide practice questions categorized by exam type. These questions often cover various topics and offer immediate feedback, enabling candidates to identify areas requiring further study.

- Study Guides: Some resources offer downloadable study guides outlining key concepts, definitions, and formulas. These guides can serve as a supplementary learning tool alongside official study materials.

- Video Tutorials: Video tutorials are becoming increasingly popular for exam preparation. These tutorials often explain complex topics in a concise and engaging format, reinforcing understanding through visual aids and clear explanations.

Types of Life Insurance Exams

The availability of free resources often aligns with the different types of life insurance exams. Understanding the specific content of each exam is critical for focused preparation.

- Exam 1: This exam often covers fundamental topics such as life insurance principles, policy features, and actuarial calculations. Candidates should be proficient in calculating premiums, determining policy values, and understanding the various types of life insurance products.

- Exam 2: This exam typically delves deeper into specific areas, such as advanced insurance products, financial planning, and investment considerations. Knowledge of financial analysis techniques and different investment vehicles is essential.

- Other Exams: Depending on the jurisdiction and the specific requirements of the licensing authority, additional exams might exist, focusing on aspects like property and casualty insurance or specific insurance regulations.

Key Topics and Concepts

A strong foundation in key topics and concepts is crucial for exam success. Understanding the intricacies of each area will allow candidates to confidently answer exam questions.

- Insurance Principles: Core principles such as risk management, insurable interest, and the concept of premiums are fundamental to understanding the functioning of insurance contracts.

- Policy Features: A thorough understanding of policy provisions, riders, and exclusions is essential. This includes coverage amounts, policy terms, and any associated costs.

- Actuarial Calculations: Examining mortality tables, calculating premiums, and understanding the principles of financial modeling is important. Understanding the concepts of risk, return, and investment analysis is key to successful calculation.

- Investment Considerations: For exams involving financial planning, candidates must understand investment strategies, risk tolerance, and asset allocation.

Resource Comparison

Evaluating different free resources helps candidates choose the best fit for their learning style and needs. A comparative analysis aids in making informed decisions.

| Resource | Format | Strengths | Weaknesses |

|---|---|---|---|

| Insurance Institute of America (IIA) Practice Questions | Practice Questions | High quality questions reflecting actual exam format; often accompanied by detailed explanations. | Limited free content; membership might be required for comprehensive access. |

| Free Insurance Courses Online | Video Tutorials | Engaging explanations and visual aids; good for visual learners. | May lack the structured practice questions for exam preparation; might not cover all topics. |

| Exam Cram | Study Guides and Practice Questions | Comprehensive study guides and targeted practice questions. | Content may be limited and not updated regularly, potentially outdated compared to current exam standards. |

Exam Strategy and Techniques

Mastering the art of exam-taking is crucial for success in life insurance licensing exams. A well-defined strategy, coupled with effective time management and targeted review techniques, can significantly improve your performance. This section details strategies and techniques to help you prepare and execute effectively during your practice exams.Effective preparation is more than just memorizing facts. It involves developing a comprehensive understanding of the material and practicing applying that knowledge in diverse scenarios.

By understanding the underlying principles and concepts, you’ll be better equipped to tackle the exam and retain the information long-term.

Approaching Practice Exam Questions

A systematic approach to answering practice questions can significantly improve your exam performance. Read each question carefully, identifying key terms and concepts. Ensure you understand what the question is asking before attempting to answer. This will prevent misinterpretations and ensure your answer addresses the specific prompt.

Time Management Techniques

Effective time management is critical for success in any exam. Allocate specific time slots for each section of the exam based on the estimated time required for each question. Develop a realistic pace and stick to it throughout the exam. Reviewing the time remaining frequently is also crucial. This allows you to adjust your approach if you are falling behind or need to move on from a challenging question.

Identifying and Focusing on Weak Areas

Pinpointing weak areas in your knowledge base is vital for targeted improvement. Analyze your practice exam results, focusing on questions you answered incorrectly. Identify recurring patterns or topics that cause difficulty. Once these areas are identified, allocate extra time and resources for dedicated study.

Reviewing Incorrect Answers

Reviewing incorrect answers is a critical part of the learning process. Don’t just look at the correct answer; actively analyzewhy* your initial answer was incorrect. Understand the underlying concepts or principles that were misunderstood. This process of self-assessment will help to solidify your understanding and prevent repeating the same mistakes.

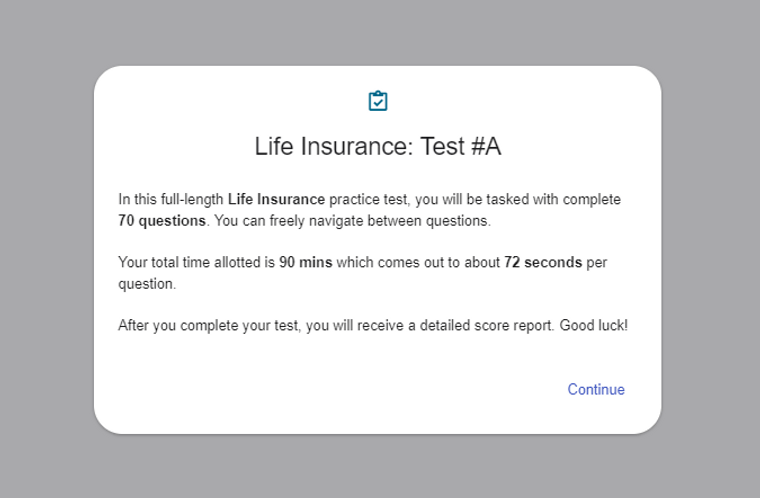

Simulating the Actual Exam Environment

Creating a realistic exam environment during practice is crucial. Set aside dedicated time for practice exams, simulating the actual exam conditions as closely as possible. This includes limiting distractions, setting a time limit, and maintaining a quiet and focused atmosphere. This process will help you build familiarity and confidence in the exam format.

Exam-Taking Strategies

| Strategy | Description | Benefits |

|---|---|---|

| Active Recall | Testing yourself without looking at the answer; this could involve recalling definitions, formulas, or case studies from memory. | Improved memory and understanding of the material, as well as identifying knowledge gaps. |

| Prioritization | Focusing on the most important and challenging questions first, then moving to easier ones. | Saves time and avoids getting stuck on a single question, increasing efficiency and overall confidence. |

| Skimming and Scanning | Quickly reviewing the material to understand the overall concepts before diving into detailed explanations. | Efficient use of time and quick identification of relevant information, especially useful for questions with multiple parts or complex scenarios. |

| Answering in Stages | Breaking down complex questions into smaller parts or steps, addressing each part sequentially. | Reduces mental overload and allows for a more organized and focused approach to tackling challenging questions. |

Key Concepts and Formulas

Mastering life insurance exam preparation hinges on understanding key concepts and formulas. These underpin the various products and their applications, enabling candidates to confidently navigate complex scenarios. Accurate application of these principles is vital for successful exam performance.Understanding the nuances of different life insurance products and their associated formulas allows for a comprehensive grasp of the subject matter.

This includes the practical application of these concepts and formulas in real-world insurance scenarios, highlighting the reasoning behind specific formulas. This detailed exploration differentiates various life insurance policies, providing a clear comparative analysis.

Important Formulas in Life Insurance

Understanding the mathematical underpinnings of life insurance is crucial. Various formulas are used to calculate premiums, death benefits, and cash values. These formulas are essential for analyzing policy performance and making informed decisions.

Unlocking the secrets of life insurance, practice makes perfect, a journey to financial foresight. Explore the avenues of free practice exams, strengthening your knowledge base. For those seeking a new home, consider the charming properties in North Plainfield, north plainfield houses for sale , where dreams take root. Navigating the complexities of life insurance, free practice tests are your guiding light, illuminating the path to success.

Mortality Tables: These tables are fundamental to life insurance calculations. They project the probability of death at different ages, forming the basis for premium calculations. Accurate mortality tables are crucial for actuaries and insurance companies to assess risk and determine appropriate premiums.

Present Value of Future Cash Flows: Life insurance policies often involve future payments (death benefits). The present value formula discounts these future cash flows to their current worth, enabling a comparison of different policy options.

Preparing for a life insurance exam demands rigorous practice. A sweet reward, like savoring a burst of Brach’s orange slice candy, can be a delightful break during your studies. Brach’s orange slice candy offers a moment of fruity bliss, while diligent practice strengthens your understanding, ensuring success in your life insurance exam.

Net Premium Calculation: This formula determines the premium required to cover the expected death benefit, accounting for mortality risks. It is a core component of insurance policy design and pricing.

Different Types of Life Insurance Policies

Life insurance encompasses various types, each catering to distinct needs and circumstances. Understanding the key differences between these policies is essential for effective exam preparation.

- Term Life Insurance: Provides temporary coverage for a specified period. Premiums are typically lower compared to permanent policies, but coverage expires after the term. Term life insurance is often used for specific financial goals, such as protecting dependents during a particular stage of life. A common application is funding a mortgage or ensuring childcare costs are covered for a certain time period.

- Permanent Life Insurance: Offers lifelong coverage, accumulating cash value over time. Premiums are generally higher than term policies. These policies provide a combination of life insurance and investment features, offering potential financial growth beyond the death benefit.

- Whole Life Insurance: A type of permanent life insurance that combines life insurance coverage with a savings component. It includes a cash value that grows over time, potentially offering investment returns and flexibility. The cash value builds over time, offering policyholders the option of borrowing against it or using it as a savings vehicle.

- Universal Life Insurance: A flexible permanent life insurance option. It allows for adjustable premiums and death benefits, making it adaptable to changing financial circumstances. Policyholders have greater control over their premium payments and coverage levels, which can be beneficial in scenarios where financial situations change.

Comparison of Life Insurance Policies

A clear comparison of policy types is essential for exam preparation. This table highlights key features and benefits of different policies:

| Policy Type | Key Features | Benefits |

|---|---|---|

| Term Life Insurance | Temporary coverage, fixed premiums for a specific period. | Lower premiums compared to permanent policies, suitable for short-term needs. |

| Whole Life Insurance | Permanent coverage, cash value accumulation, fixed premiums. | Builds cash value over time, offers death benefit and savings potential. |

| Universal Life Insurance | Permanent coverage, adjustable premiums and death benefits. | Flexibility in premium payments and coverage, potential for higher returns depending on investment performance. |

| Variable Life Insurance | Permanent coverage, cash value invested in variable funds. | Potential for higher returns than whole or universal life, but with higher investment risk. |

Common Mistakes and How to Avoid Them

Failing to grasp fundamental concepts and committing errors during exam preparation can significantly impact success. Understanding common pitfalls and implementing effective strategies to circumvent them is crucial for achieving a positive outcome. Recognizing these mistakes allows for proactive adjustments and fosters a more effective learning experience.Common errors in life insurance exam preparation often stem from inadequate study habits, a lack of focused practice, or a misunderstanding of key concepts.

These errors can lead to incorrect answers and a lower overall score. Proactive identification and mitigation of these errors are vital to optimize exam performance and increase the likelihood of success.

Misunderstanding Policy Terms

Thorough comprehension of policy terms is paramount for accurate exam performance. Many students struggle with deciphering the nuances of policy language. Careless reading or a lack of in-depth analysis can lead to a misunderstanding of critical provisions, exclusions, and benefits. This can result in misinterpretations of policy features and their implications, hindering accurate responses during the exam.

This, in turn, can lead to incorrect answers and lower scores.

Incorrect Application of Formulas

Many formulas in life insurance are intricate and require precise application. Careless calculation errors, misunderstanding of variable usage, or neglecting essential steps in the formula application process can result in significant errors. A thorough understanding of each formula’s components and precise application is critical for accurate results. Failure to adhere to these principles can lead to inaccurate calculations, incorrect conclusions, and, consequently, poor exam scores.

Inadequate Practice and Review

Limited practice and inadequate review of learned materials can result in a lack of retention and comprehension. This leads to a weaker grasp of concepts, hindering the ability to apply knowledge during the exam. A lack of structured practice and review often results in a lower understanding of concepts, affecting the ability to apply them accurately.

Insufficient Time Management

Time constraints during the exam can lead to rushed decisions, careless errors, and a lack of thorough review. Effective time management strategies are critical for successful exam completion. Students often struggle with managing their time effectively, resulting in rushed answers and potential errors.

Table of Common Mistakes and Solutions, Practice life insurance exam free

| Mistake | Explanation | Solution |

|---|---|---|

| Misunderstanding Policy Terms | Lack of thorough reading and analysis of policy documents. | Carefully review policy documents, paying close attention to specific terms, exclusions, and benefits. Utilize practice questions that focus on policy interpretation. |

| Incorrect Application of Formulas | Careless calculation errors or misunderstanding of formula components. | Thoroughly review each formula, understanding its variables and steps. Practice applying the formulas repeatedly with different scenarios. |

| Inadequate Practice and Review | Insufficient practice questions and lack of review sessions. | Develop a structured study plan that incorporates regular practice with various types of practice questions. Schedule dedicated review sessions to reinforce learned concepts. |

| Insufficient Time Management | Rushed decisions during the exam due to insufficient time allocation. | Practice time management techniques, such as pacing yourself and allocating specific time for each section. Take practice exams under timed conditions to simulate the actual exam environment. |

Study Resources and Recommendations: Practice Life Insurance Exam Free

Effective preparation for life insurance exams requires a strategic approach that combines quality study materials with efficient study methods. This section details reputable resources, compares various study techniques, and provides a structured study schedule to maximize your learning and increase your chances of success.

Reputable Study Materials

Comprehensive study materials are crucial for mastering the intricate concepts of life insurance. Recognized publishers and reputable online resources offer a wide array of study guides, practice exams, and supplemental materials. These resources often include detailed explanations, examples, and practice questions, which can significantly aid in understanding complex topics.

- Exam Prep Books: Leading publishers frequently release study guides tailored to specific life insurance exams. These books typically cover all essential topics, offering in-depth explanations and examples, as well as practice questions. For example, Kaplan and Schweser are well-regarded publishers known for their comprehensive and effective study guides.

- Online Courses: Many online platforms provide interactive courses and practice exams designed to prepare students for life insurance exams. These courses often offer flexible learning options, including video lectures, interactive exercises, and personalized feedback, allowing for self-paced study and targeted review of challenging concepts. Examples include reputable online education platforms.

- Practice Exams: Practice exams are indispensable tools for assessing knowledge retention and identifying areas needing further study. They simulate the actual exam environment, helping students become familiar with the format and time constraints. These resources are often available as part of comprehensive study guides or independently from various online providers.

Comparison of Study Methods

Choosing the right study method is crucial for effective learning. Different approaches work for different individuals.

- Active Recall: This method involves actively retrieving information from memory rather than passively rereading material. Techniques like flashcards and self-testing promote deeper understanding and long-term retention.

- Spaced Repetition: This method involves reviewing material at increasing intervals. This approach reinforces learning and prevents forgetting by revisiting topics at progressively longer intervals.

- Flashcards: Flashcards are effective tools for memorizing key terms, formulas, and definitions. They allow for focused review and quick access to information, especially when combined with active recall techniques.

- Mind Mapping: Visual aids, such as mind maps, can effectively organize complex information and establish connections between different concepts. This technique enhances understanding and recall, especially when dealing with interconnected topics.

Importance of a Study Schedule

A well-structured study schedule is critical for managing time effectively and maintaining focus throughout the preparation process. It helps in creating a consistent study routine and allows for appropriate allocation of time to each topic. A well-planned schedule promotes discipline and helps prevent procrastination.

Sample Study Schedule

A sample study schedule for exam preparation, tailored to a typical study pattern, is presented below. This is a template and should be adapted to individual learning styles and needs.

| Day | Topic | Activities |

|---|---|---|

| Monday | Fundamentals of Life Insurance | Review key concepts, complete practice questions, and attend an online lecture. |

| Tuesday | Policy Types | Study various policy types, compare features, and practice calculations. |

| Wednesday | Mortality Tables | Understand mortality tables and their application in life insurance calculations. |

| Thursday | Review and Practice | Review all topics covered this week, and practice multiple-choice questions. |

| Friday | Practice Exam | Take a full-length practice exam under timed conditions. |

Staying Motivated

Maintaining motivation during the exam preparation process is essential for consistent progress. Celebrate milestones, break down large tasks into smaller, manageable steps, and reward yourself for achieving specific goals.

Ending Remarks

So, you’re ready to conquer your life insurance exam? This guide has equipped you with the tools, resources, and strategies to succeed. Remember to practice consistently, focus on your weak areas, and stay motivated throughout your preparation. You got this! Now go out there and ace that exam!

Questions Often Asked

What if I don’t have any prior insurance knowledge?

No worries! This guide provides a solid foundation. Start with the key concepts and gradually build your understanding through practice questions and study resources. It’s all about breaking it down step-by-step.

How long does it typically take to prepare for a life insurance exam?

The time it takes depends on your current knowledge and the exam’s difficulty. Use the study schedule as a starting point, but adjust it based on your individual needs. Consistency is key!

Are there any specific study techniques you recommend?

Active recall, like testing yourself without looking at the answers, is a powerful technique. Reviewing incorrect answers and identifying your weak areas are also crucial. Mix up your study methods for optimal results.

Can you recommend some reliable free online resources?

We cover a variety of free resources in the guide, so be sure to check it out. We’ll give you a breakdown of the strengths and weaknesses of each resource to help you choose the ones that best suit your learning style.